Practice 4.6 Balance of Payments with authentic IB Economics exam questions for both SL and HL students. This question bank mirrors Paper 1, 2, 3 structure, covering key topics like microeconomics, macroeconomics, and international trade. Get instant solutions, detailed explanations, and build exam confidence with questions in the style of IB examiners.

Albania is a country in Southeastern Europe with an estimated population of about 2.8 million in 2022. The Albanian economy has been transitioning from a centrally planned system to a market-based system and has experienced positive real GDP growth in recent years. Tourism is a significant contributor to Albania’s GDP, and the government has intensified efforts to promote the country’s attractions along its Adriatic and Ionian coasts.

In 2022, Albania’s unemployment rate was around 12%, partly due to structural challenges in the economy. The government operates a progressive personal income tax system, with rates ranging from 0% up to 23%. Corporate income tax is set at 15%. Value-added tax (VAT) on most goods and services stands at 20%.

Albania’s trade balance remains negative, as the country’s main exports (textiles, footwear, and mineral fuels) have not kept pace with imports (machinery, food, and manufactured goods). The government has embarked on several infrastructural projects to attract foreign investment and reduce transport costs, including a newly announced US$200 million investment in highways. Economists estimate the marginal propensity to consume (MPC) in Albania to be about 0.8.

Table 1: Selected Macroeconomic Indicators for Albania

| Year | Real GDP (billion US$) | Unemployment Rate (%) | Gini Coefficient |

|---|---|---|---|

| 2021 | 15.2 | 11.5 | 0.30 |

| 2022 | 16.0 | 12.0 | 0.31 |

Table 2: Tourism Data in Albania (2022)

| Price per Tour Package (EUR) | Quantity Demanded of Tour Packages (thousands) |

|---|---|

| 400 | 140 |

| 450 | 120 |

Using the information provided in Table 1, calculate the percentage change in Albania’s real GDP between 2021 and 2022.

The Albanian government’s US$200 million highway project is expected to raise national income through the Keynesian multiplier, assuming the marginal propensity to consume (MPC) is 0.8. Calculate the total increase in national income that could result from this project.

Using the data in Table 2, calculate the price elasticity of demand (PED) for Albania’s tour packages when the price increases from EUR 400 to EUR 450.

Using the data in Table 1, calculate the absolute change in the unemployment rate between 2021 and 2022.

Define the term “progressive tax.”

Using an AD/AS diagram, explain how an increase in government spending on infrastructure could affect real GDP in Albania.

Using information from Table 1, calculate the approximate percentage change in Albania's Gini coefficient between 2021 and 2022. Show your working.

Using information from the text, explain how a persistent trade deficit might impact Albania’s economic growth.

Using the text/data provided and your knowledge of economics, recommend a policy which the government of Albania could implement in order to reduce unemployment.

ECONOMIC DEVELOPMENTS AND CHALLENGES IN VANUATU

(1) Vanuatu is a small archipelago nation in the South Pacific, consisting of over 80 islands. Despite its relatively small population of approximately 320,000 people, the country has shown steady economic growth in recent years. In 2019, Vanuatu’s nominal GDP reached US$950 million, but tourism-related disruptions caused by global events in 2020 and 2021 have posed significant economic setbacks. Additionally, rural communities remain reliant on subsistence agriculture, and the government is focused on introducing policies to foster both macroeconomic stability and inclusive growth.

(2) Tourism is the backbone of Vanuatu’s economy, accounting for more than 40% of GDP in 2019. However, the tourism industry was severely impacted by travel restrictions in 2020, leading to an estimated contraction in real GDP of 7%. Inflation remained moderate at around 3% in 2021, due in part to subdued demand and government measures to stabilize food prices. The authorities are closely monitoring the exchange rate of the vatu against major currencies to support export competitiveness and manage imported inflation.

(3) On the microeconomic front, small-scale farming and fishing dominate local livelihoods. Many households engage in subsistence agriculture, producing staple crops like taro and cassava. Recent government programs offer microcredit to smallholder farmers, aiming to increase efficiency and diversify agricultural output. In 2021, about 2,500 farmers benefited from these loans, collectively raising production of cocoa beans and kava, two key export products. Nonetheless, the challenge of inadequate transport infrastructure persists, limiting market access and driving up costs.

(4) Internationally, Vanuatu has aimed to reduce trade barriers. The country became a World Trade Organization (WTO) member in 2012, contributing to lower tariff rates, currently averaging 9% across key imports. In 2021, Vanuatu’s merchandise trade balance was slightly negative, primarily due to higher imports of machinery and intermediate goods required for infrastructure projects. The government hopes the easing of administrative barriers will inspire greater foreign direct investment (FDI), especially in tourism and fisheries. According to official estimates, FDI inflows rose to US$55 million in 2021, although most of these investments concentrated on hospitality projects near Port Vila.

(5) Over the past few years, Vanuatu’s Ministry of Agriculture has championed climate-resilient farming methods. In 2020, an estimated 18% of rural households adopted drought-tolerant seeds and new irrigation systems to mitigate climate risks, supported by international donors. While these initiatives have marginally increased production costs, they also have the potential to enhance productivity and reduce vulnerability to cyclones and droughts.

(6) Concerns over income inequality have drawn attention to inefficiencies in the delivery of social services. Although the official Gini coefficient is not publicly reported annually, the government acknowledges uneven distribution of income, with urban centers such as Port Vila attracting higher wages and better services. Rural electrification programs and community-based healthcare projects have been proposed to reduce disparities, though progress is gradual given fiscal limitations.

(7) In line with ongoing development plans, the government has embarked on a new “Tourism Transformation Strategy,” introduced in late 2021, aimed at diversifying tourist offerings beyond coastal resorts. Officials foresee growth in eco-tourism activities such as trekking and cultural tours, tapping into the rising global demand for sustainable travel. Additionally, the forecasted resumption of regular cruise ship visits in 2022 is expected to bolster small businesses that cater to incoming tourists. The Ministry of Finance anticipates that these policies could lead to an annual real GDP growth rate of approximately 5% by 2023, provided external conditions remain stable.

(8) While the medium-term outlook is optimistic, Vanuatu faces the long-term challenge of balancing environmental sustainability with ambitions for continued growth. Policy efforts target infrastructure development—particularly in transport and digital connectivity—to integrate rural producers into broader markets and lessen reliance on a limited range of commodities. With strategic planning and wider partnerships, officials hope Vanuatu can enhance economic resilience, accommodate a rising population, and reduce poverty more effectively.

Table 1: Selected Macroeconomic Indicators for Vanuatu (2018–2021)

| Indicator | 2018 | 2019 | 2020 | 2021 |

|---|---|---|---|---|

| Nominal GDP (US$ million) | 900 | 950 | 880 | 900 |

| Real GDP Growth Rate (%) | 3.2 | 3.8 | -7.0 | 1.0 |

| Inflation Rate (%) | 2.5 | 2.7 | 3.0 | 3.0 |

| Exchange Rate (vatu per US$) | 113.0 | 110.5 | 111.0 | 110.0 |

| Government Budget Balance (% of GDP) | -3.1 | -2.8 | -6.0 | -5.2 |

| Tourist Arrivals (thousands) | 330 | 345 | 100 | 120 |

Table 2: Sectoral Contribution to GDP in 2021

| Sector | Share of GDP (%) |

|---|---|

| Tourism (direct) | 22 |

| Agriculture | 18 |

| Fisheries | 7 |

| Manufacturing | 9 |

| Services (excl. tour.) | 34 |

| Other | 10 |

(a) (i) Define the term “foreign direct investment” mentioned in paragraph 4.

(a) (ii) Define the term “exchange rate” mentioned in paragraph 2.

(b) (i) Using information from Table 1, calculate the change in Vanuatu’s nominal GDP (in US$ million) from 2019 to 2021.

(b) (ii) Sketch an aggregate demand and aggregate supply (AD/AS) diagram to show how fluctuations in the tourism sector (paragraph 2) might affect the overall price level in Vanuatu.

(c) Using a demand-and-supply diagram for agricultural products, explain how the government’s microcredit program for farmers (paragraph 3) could influence the market for cocoa beans or kava.

(d) Using a tariff diagram, explain how Vanuatu’s membership in the World Trade Organization (paragraph 4) impacts import prices and consumer surplus.

(e) Using a Lorenz curve diagram, explain how uneven distribution of income (paragraph 6) might influence the degree of inequality in Vanuatu.

(f) Using a business cycle diagram, explain how the sharp decline in real GDP in 2020 (Table 1) represents a recessionary phase for Vanuatu.

(g) Using information from the text/data (especially Table 2) and your knowledge of economics, discuss the extent to which Vanuatu’s new “Tourism Transformation Strategy” (paragraph 7) can promote long-term economic growth and development.

Economic Developments in Uzbekistan

Uzbekistan, located in Central Asia, has undergone significant economic reforms since 2017, including currency liberalization, tax reforms, and measures to attract foreign direct investment (FDI). Historically reliant on cotton exports and gold mining, the country has started diversifying into emerging sectors such as automotive and tourism. Between 2018 and 2022, real GDP growth averaged 5.5% per year, supported by increasing remittances from Uzbek workers abroad and rising domestic consumption. However, inflation reached 10% in 2021, driven mainly by higher food prices and imported goods.

The government has prioritized infrastructure development, investing in roads, railways, and energy grids. Such projects have attracted a number of international firms, particularly from China and Russia. Yet, small and medium-sized enterprises (SMEs) in Uzbekistan argue that high interest rates and limited access to capital inhibit their competitiveness. To address this, the Central Bank of Uzbekistan has eased monetary policy gradually, aiming to lower borrowing costs for businesses.

Despite reforms and steady growth, poverty remains a pressing concern. Official data indicate that nearly 11% of the population lived below the national poverty line in 2020, a figure the government aims to reduce to 7.8% by 2025 through poverty-targeted social programs. In rural areas, a cycle of low incomes, limited job opportunities, and inadequate healthcare has trapped many households in persistent poverty. To break this cycle, government policies have focused on expanding vocational training, improving rural education, and providing microfinance to small-scale farmers.

Agriculture continues to play a significant role in Uzbekistan’s economy, accounting for over 25% of total employment. Wheat and cotton farmers benefit from state procurement policies, although reforms aim to reduce direct government involvement and move toward more market-based pricing. While these measures have improved efficiency, concerns about water scarcity and the environmental impact of intensive cotton cultivation persist. The government also subsidizes fertilizer and irrigation technology to boost agriculture yields, which has partially alleviated rural poverty but raises questions about long-term sustainability.

On the international front, Uzbekistan has taken steps to improve trade relations with neighboring countries through tariff reductions and simplified customs procedures. As a landlocked country, it relies on joint infrastructure projects across Central Asia to drive export growth. Exports include natural gas, cotton, gold, and an increasing volume of textiles and foodstuffs. FDI inflows have accelerated as the government strengthens legal protections for foreign investors, though volatility remains a risk due to global economic shifts and geopolitical tensions in the region.

Income inequality is a growing focus for policymakers. While official surveys suggest moderate improvement in the Gini coefficient since 2015, critics argue the informal sector obscures true disparities. Remittances from migrant workers—predominantly in Russia—have helped households combat poverty but also highlight Uzbekistan’s dependence on external labor markets. In response, the government is encouraging labor-intensive manufacturing and tourism to create domestic employment opportunities.

The Central Bank maintains a managed float of the Uzbek som, occasionally intervening to stabilize exchange rate fluctuations. Recent data show gradual appreciation of the currency as export revenues climb. Nonetheless, the significant share of the population living on subsistence farming underscores the importance of inclusive growth. Policies that bolster human capital—such as investments in education, healthcare, and vocational training—are viewed as critical to sustainable development.

Going forward, analysts see opportunities for Uzbekistan to leverage its strategic location as a transit hub between East and West. However, challenges such as ensuring water security, upgrading outdated infrastructure, and reducing dependence on extractive industries remain. Whether the current pace of reforms can translate into long-term, diversified growth will depend on the government’s ability to balance macroeconomic stability, social needs, and international integration.

Table 1: Selected Macroeconomic Indicators for Uzbekistan (2018–2022)

| Indicator | 2018 | 2019 | 2020 | 2021 | 2022 |

|---|---|---|---|---|---|

| Nominal GDP (US$ billion) | 50.4 | 57.2 | 60.0 | 65.8 | 73.1 |

| Real GDP Growth Rate (%) | 5.1 | 5.6 | 1.6 | 7.4 | 5.0 |

| Inflation Rate (%) | 14.3 | 13.0 | 11.5 | 10.0 | 9.5 |

| Unemployment Rate (%) | 9.3 | 9.0 | 10.5 | 10.1 | 9.7 |

| Exchange Rate (UZS per US$) | 8200 | 9300 | 10400 | 10800 | 11050 |

| Current Account Balance (% of GDP) | -7.0 | -5.5 | -5.0 | -5.2 | -4.0 |

Table 2: Poverty, Employment, and Development Indicators

| Indicator | 2018 | 2019 | 2020 | 2021 | 2022 |

|---|---|---|---|---|---|

| Population (million) | 32.6 | 33.2 | 33.9 | 34.5 | 35.0 |

| Poverty Rate (% of population) | 12.1 | 11.5 | 11.0 | 10.5 | 10.0 |

| Rural Population (% of total) | 49.6 | 49.2 | 48.9 | 48.5 | 48.2 |

| Remittances Inflows (US$ billion) | 7.8 | 8.5 | 6.9 | 8.0 | 9.2 |

| Gini Coefficient (0 = perfect equality) | 0.32 | 0.32 | 0.31 | 0.31 | 0.30 |

| Government Spending on Education (% of GDP) | 4.5 | 4.6 | 5.0 | 5.1 | 5.3 |

(a) (i) Define the term “inflation” as used in the text (paragraph 1).

(a) (ii) Define the term “foreign direct investment (FDI)” as used in the text (paragraph 2).

(b) (i) Using information from Table 1, calculate the total increase in Uzbekistan’s nominal GDP (in US$ billion) between 2018 and 2022.

(b) (ii) Sketch an AD/AS diagram to show how rising domestic consumption (paragraph 1) could have contributed to the inflation trends indicated in Table 1.

(c) Using a demand-and-supply-of-currency diagram, explain how growing export revenues (paragraph 7) might affect the exchange rate of the Uzbek som.

(d) Using a production possibilities curve (PPC) diagram, explain how investments in infrastructure (paragraph 2) may impact Uzbekistan’s long-run potential output.

(e) Using a Lorenz curve diagram, explain the significance of the change in Uzbekistan’s Gini coefficient (Table 2).

(f) Using a poverty cycle diagram, explain how limited access to education and finance (paragraph 3) could trap rural households in persistent poverty.

(g) Using information from the text/data and your knowledge of economics, evaluate the impact of Uzbekistan’s poverty-targeted social programs and agricultural reforms on long-term economic growth and development.

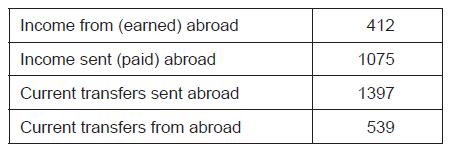

Table 5 shows selected items of the balance of payments for Laylaland in 2020. Figures are in millions of US dollars (US$).

Table 5

Laylaland has a current account deficit of US$1865 million.

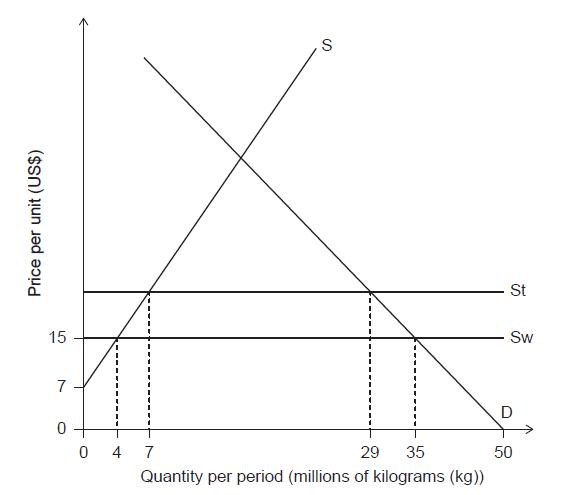

Chia seeds are an agricultural good produced in many countries and priced in US dollars (US$).

Figure 1 illustrates the market for chia seeds in a small country called Nofiberland. D is the domestic demand and S is the domestic supply for chia seeds. Chia seeds can be initially imported at the current world price of US$15.00 per kg. Sw is therefore the world supply faced in Nofiberland with free trade. To protect Nofiberland producers, the government decides to impose a US$6.00 tariff on chia seed imports. St is therefore the world supply faced in Nofiberland after the tariff is imposed.

Figure 1

Quinoa is a great source of protein and is thus considered a “super food”. As a result, the demand for quinoa in advanced economies has lately been rising very fast while global supply has not changed. A small country called Proteinland gets 80 % of its export revenues from exporting quinoa to advanced economies.

Distinguish between credit and debit items in the balance of payments.

State one example of a debit item from the financial account of the balance of payments.

Using Table 5, calculate the value of net current transfers for Laylaland in 2020.

Using Table 5, calculate the net exports of goods and services for Laylaland in 2020.

Explain two methods that Laylaland’s government could use to correct the current account deficit.

List two administrative barriers that Nofiberland could have used to limit imports of chia seeds.

Calculate the price elasticity of demand for chia seeds in Nofiberland following the imposition of the tariff.

Calculate the change in consumer expenditure on imported chia seeds in Nofiberland resulting from the imposition of the tariff.

Calculate the total welfare loss resulting from the imposition of the tariff on chia seeds.

Outline one reason why the imposition of the tariff would lead to a welfare loss.

Describe the impact of the rise in demand for quinoa on the terms of trade of Proteinland.

Explain how the increase in world demand for quinoa would likely affect the current account balance of Proteinland.

Country X has been experiencing fluctuations in its trade balance, economic growth, and taxation policies. The government is considering various measures to improve macroeconomic stability. The following tables provide data on key economic indicators.

Table 1: Balance of Payments

| Category | Q1 | Q2 | Q3 | Q4 | Total |

|---|---|---|---|---|---|

| Balance of trade in goods | 3,500 | 4,200 | 3,800 | 4,600 | 16,100 |

| Balance of trade in services | -1,800 | -2,000 | -2,200 | -2,500 | -8,500 |

| Income | -3,000 | -3,500 | -3,400 | -3,600 | -13,500 |

| Current transfers | 200 | 300 | 250 | 400 | 1,150 |

Table 2: Price Elasticity of Demand (PED) for Selected Goods

| Product | Initial Price (USD) | New Price (USD) | Initial Quantity | New Quantity |

|---|---|---|---|---|

| Oil | 50 | 55 | 1,000 | 900 |

| Coffee | 5 | 6 | 5,000 | 4,800 |

Table 3: Taxation Revenue and GDP

| Year | GDP (billion USD) | Tax Revenue (billion USD) |

|---|---|---|

| 2020 | 500 | 100 |

| 2021 | 530 | 110 |

| 2022 | 550 | 115 |

Using information from Table 1, calculate the current account balance for Country X in Q2.

Provide one reason why the balance of trade in services might be negative for Country X.

Using Table 2, calculate the price elasticity of demand (PED) for oil.

Using Table 2, calculate the price elasticity of demand (PED) for coffee.

Define the term Keynesian multiplier.

Using Table 3, calculate the tax-to-GDP ratio for the year 2021.

Draw a diagram to illustrate the impact of an indirect tax on a market.

Explain how an indirect tax affects both producer and consumer surplus using the diagram sketched in the previous question.

Using the text/data provided and your knowledge of economics, recommend a policy which could be implemented by Country X to reduce its current account deficit.

Italy is the Eurozone’s third largest economy. Although it experienced a sharp contraction in 2020 due to the global pandemic, economic recovery followed in 2021 and 2022, partly driven by an upturn in manufacturing and consumer spending. Italy’s unemployment rate, however, remains higher than the European Union average. Income inequality, measured by the Gini coefficient, is moderate but still a concern for policymakers aiming to promote inclusive growth.

Italian coffee culture remains a vital part of domestic consumption. Table 2 provides data for the market for coffee beans. Despite fluctuations in demand and price, Italy’s coffee imports and exports of processed coffee products continue to be important for the country’s trade balance.

In 2021, Italy’s exports of manufactured goods such as machinery and vehicles led to a small trade surplus, as shown in Table 3. The government also relies on progressive income taxes to finance public spending. Some economists argue that a well-designed policy could improve both growth prospects and income distribution.

Table 1: Selected Macroeconomic Data for Italy

| Year | Real GDP (billion €) | Real GDP growth (%) | Unemployment rate (%) | Gini coefficient |

|---|---|---|---|---|

| 2020 | 1,650 | -8.9 | 9.3 | 0.33 |

| 2021 | 1,730 | 4.8 | 9.5 | 0.34 |

| 2022 | 1,795 | 3.8 | 8.9 | 0.33 |

Table 2: Market for Coffee Beans in Italy (Hypothetical Data)

| Price per kg (€) | Quantity Demanded (thousand kg/month) | Quantity Supplied (thousand kg/month) |

|---|---|---|

| 8 | 35 | 18 |

| 9 | 32 | 23 |

| 10 | 29 | 29 |

| 11 | 25 | 34 |

Table 3: Italy’s Key Trade Data (2021)

| Exports (billion €) | Imports (billion €) | Main Export Goods (share %) | Main Import Goods (share %) |

|---|---|---|---|

| 510 | 480 | Machinery (18%), Vehicles (10%), Food & Beverage (8%) | Energy (15%), Machinery (14%), Chemicals (12%) |

Using the information in Table 2, calculate the price elasticity of demand (PED) for coffee beans when the price increases from €9 to €10 per kg.

Using the data in Table 1, calculate the approximate percentage change in Italy’s real GDP from 2020 to 2022.

Refer to Table 3. Calculate the net exports for Italy in 2021 and state whether the trade balance was in surplus or deficit.

Using information in Table 2, calculate the excess demand or excess supply of coffee beans at a price of €8 per kg.

Define the term “progressive tax.”

Using an aggregate demand and aggregate supply (AD/AS) diagram, explain how a rise in consumer spending (as indicated by the increase in real GDP in Table 1) might affect real output and the price level in Italy.

Using the information in Table 2, calculate the price elasticity of supply (PES) for coffee beans when the price increases from €9 to €10 per kg.

Using information from the text above, explain how income inequality might pose a challenge to Italy’s long-term economic growth.

Using the text/data provided and your knowledge of economics, recommend a policy which could be implemented by the Italian government to promote more equitable economic growth.

Poland has experienced steady economic growth in recent years, supported by a diverse industrial base, significant agricultural production, and growing service sectors. The country is a major producer of apples, exporting large quantities to neighboring European countries. The government imposes several taxes, including value-added tax (VAT) and progressive personal income tax. In 2022, policymakers considered pursuing expansionary monetary policies to stimulate the economy amid signs of a possible slowdown.

Table 1 shows selected macroeconomic data for Poland from 2019 to 2022.

| Year | Nominal GDP (PLN billions) | Price Index (2019 = 100) |

|---|---|---|

| 2019 | 2300 | 100 |

| 2020 | 2400 | 102 |

| 2021 | 2510 | 105 |

| 2022 | 2640 | 108 |

Table 2 outlines Poland’s major tax rates.

| Type of Tax | Rate of Tax |

|---|---|

| Corporate income tax (CIT) | 19 % |

| Personal income tax (PIT) | Progressive, from 17 % to 32 % |

| Value-added tax (VAT) | 23 %, 8 %, 5 %, 0 % |

Poland’s Gini coefficient stands at 0.305, reflecting moderate income inequality. Estimates suggest that the average marginal propensity to consume (MPC) in Poland is approximately 0.75. Table 3 provides recent data about the Polish apple market.

| Price (PLN per kg) | Quantity Demanded (tonnes) |

|---|---|

| 3.00 | 200,000 |

| 3.30 | 170,000 |

In 2021, the total export revenue from Polish apples stood at 500 million PLN. By 2022, this figure had risen to 600 million PLN. These trends highlight Poland’s continued importance in the international apple market.

Using information from Table 1, calculate the rate of real GDP growth from 2021 to 2022.

If the marginal propensity to consume (MPC) in Poland is 0.75, calculate the Keynesian multiplier for the Polish economy.

Using information from Table 3, calculate the price elasticity of demand for Polish apples as the price increases from 3.00 PLN per kg to 3.30 PLN per kg.

Using the information provided, calculate the change in the value of Poland’s apple export revenue from 2021 to 2022.

Define the term “Gross Domestic Product”.

Using an AD/AS diagram, explain how an expansionary monetary policy might affect real output (GDP) and the price level in Poland.

Using information from Table 1, calculate the approximate rate of inflation in Poland between 2020 and 2021. Show your working.

Using information from the text, explain two ways in which moderate income inequality (as indicated by a Gini coefficient of 0.305) might affect Poland’s economic growth.

Using the text/data provided and knowledge of economics, recommend a policy which could be implemented by the Polish government to help reduce income inequality in Poland.

Current account deficit poses a challenge to Pakistan’s economy

Pakistan’s president has raised concerns about the increasing current account deficit, which grew to USD 12.12 billion in 2016/17 from USD 4.86 billion in 2015/16. This deficit is driven by rising imports and declining exports. Due to low prices of the imported goods in foreign markets, the president has proposed restricting the import of luxury, non-essential goods through quotas, aiming to mitigate the issue and reduce dependence on external borrowing.

The governor of Pakistan’s central bank supports the president’s concern, emphasizing that excessive non-essential imports contribute to the deficit and require borrowing from abroad. However, he noted that 32% of imports consist of capital goods essential for the growth of small and medium enterprises (SMEs), agriculture, and construction.

Central bank advisors have suggested depreciating the rupee to address the trade deficit. The currency operates under a managed exchange rate system and is estimated to be overvalued by 20%. However, the central bank governor warns of the negative effects of depreciation, such as higher inflation.

Pakistan’s economic growth reached 5.3% in 2016, its highest in a decade, with an estimated increase to 6% in 2017. The government believes that boosting SME loans from 7-8% to 15-17% of total business loans will further enhance economic growth.

In addition to the current account deficit, fiscal policy decisions have led to a budget deficit, increasing public debt to 62% of GDP in 2016. The central bank recommends limiting public debt to 60% of GDP.

Table 1: Pakistan’s Current Account Data

| Year | Exports (US$ billion) | Imports (US$ billion) | Current Account Deficit (US$ billion) |

|---|---|---|---|

| 2015/16 | 22.0 | 26.86 | 4.86 |

| 2016/17 | 21.5 | 33.62 | 12.12 |

Table 2: Key Economic Indicators

| Year | GDP Growth Rate (%) | SME Loans (% of total business loans) | Public Debt (% of GDP) | Rupee Overvaluation (%) |

|---|---|---|---|---|

| 2016 | 5.3 | 7.5 | 62 | 20 |

| 2017 | 6.0 | 8.0 | 65 | 18 |

Define the term "current account".

List two fiscal policy measures.

Using information from Table 1, calculate the percentage increase in Pakistan’s current account deficit from 2015/16 to 2016/17.

Draw a diagram to show the effect of a low price of foreign goods on the quantity imported by Pakistan.

Using an exchange rate diagram, explain how a depreciation of the rupee could impact Pakistan’s trade balance.

Using an AD/AS diagram, explain how an increase in government debt could affect economic growth.

Using a demand and supply diagram, explain how restricting luxury imports may affect domestic production in Pakistan.

Using information from the text/data and your knowledge of economics, evaluate Pakistan's current measures effectiveness in achieving long-run economic growth and/or development.

A country, Econland, has been experiencing significant trade imbalances, with a persistent current account deficit. The country has an overreliance on imported manufactured goods while its primary exports include raw materials such as agricultural produce and minerals. The government has introduced a protectionist policy to restrict the importation of specific goods by imposing tariffs and quotas.

In addition to trade imbalances, Econland faces sluggish GDP growth, increasing income inequality, and fluctuating tax revenues. The government is evaluating fiscal and monetary policies to stimulate growth while maintaining economic stability.

Table 1: Trade Balance of Econland (in USD Million)

| Year | Exports | Imports | Trade Balance |

|---|---|---|---|

| 2021 | 200 | 230 | -30 |

| 2022 | 200 | 180 | ? |

Table 2: Price Elasticity of Demand (PED) for Selected Imported Goods

| Good | % Change in Quantity Demanded | % Change in Price | PED |

|---|---|---|---|

| Electronics | -10% | 20% | ? |

| Vehicles | -8% | 16% | ? |

Table 3: Tax Revenue and GDP Growth in Econland

| Year | Tax Revenue (in billion USD) | GDP Growth Rate (%) |

|---|---|---|

| 2021 | 50 | 3.2 |

| 2022 | 52 | 3.5 |

| 2023 | 55 | ? |

Table 4: Gini Coefficient and Income Distribution

| Year | Gini Coefficient |

|---|---|

| 2021 | 0.42 |

| 2022 | 0.44 |

| 2023 | ? |

Using information from Table 1, calculate the new trade balance of Econland after the reduction in imports. Show your working.

Explain why protectionist policies may impact domestic production and employment in the short run.

Using information from Table 2, calculate the PED for Electronics and Vehicles. Show your working.

Using information from Table 3, calculate the GDP Growth Rate in 2023 if GDP increased by 80 billion USD from the previous year.

Define the term Gini coefficient.

Using information from Table 4, calculate the percentage change in the Gini coefficient from 2021 to 2022.

Draw a diagram to illustrate the effect of imposing a tariff on imports in Econland’s market.

Using information from Table 3, explain the relationship between tax revenue and GDP growth in Econland.

Using the text/data provided and your knowledge of economics, recommend a policy that Econland could implement to reduce income inequality while maintaining economic growth. Justify your answer with economic reasoning.

Study the following extract and answer the questions that follow. The Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP), Australia and Japan 1 In 2018, Australia signed the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP)*. The agreement creates the third largest free trade area in the world, covers nearly 500 million people and is worth more than US70 billion, but some industries would be negatively affected. 3 Japanese farmers are worried about the increase in imported food from Australia. Furthermore, the Japanese government is concerned about the effects of the CPTPP on Japan's food self-sufficiency—Japan relies on other countries for over 60% of its food. In response to these concerns the Japanese government has offered support for domestic farmers to diversify production into other crops. The government also plans to subsidize the rice farmers through the initial phase of lowering trade barriers. 4 The agreement is said to be worth more than US$37 billion to Australian agricultural exports. It is hoped that CPTPP and the falling value of the Australian dollar will help Australia to reduce its current account deficit, but some economists have argued that this can take a long time. According to some estimations, the short-run price elasticity of demand (PED) for Australian exports is 0.2 and the short-run PED for imports in Australia is 0.4. However, the long-run PED for Australian exports is 1.1 and the long-run PED for imports in Australia is 1.3. 5 There have also been concerns about the CPTPP from trade unions in Australia. They argue that it deregulates the labour markets and gives corporations from other countries an ability to take legal action against governments for implementing laws that raise wages or protect the environment, if the foreign corporation can prove that the law hurt their commercial interests. One university lecturer said that the future costs to the taxpayer could be significant if foreign companies take the Australian government to court. 6 The trade agreement would allow workers from other countries to work in Australia without employers being required to check if Australian citizens are available to fill the jobs before the migrant workers are employed. It is estimated this may risk 39000 jobs in Australia. Furthermore, environmental activists have expressed concerns that the negative environmental and social effects of the agreement have not been well considered. This may lead to conflicts with Australia's commitment to the United Nations' Sustainable Development Goals. * The CPTPP includes eleven member countries: Australia, Brunei, Canada, Chile, Japan, Malaysia, Mexico, New Zealand, Peru, Singapore and Vietnam.

Define the term free trade area indicated in bold in the text (paragraph 1).

Define the term quotas indicated in bold in the text (paragraph 2).

Using price elasticity of demand (PED) data from the text and the J-curve effect, explain the most likely impact of "the falling value of the Australian dollar" on Australia's current account (paragraph 4).

Using an international trade diagram, explain how "increased quotas for the export of rice to Japan" will affect the price of rice in Japan (paragraph 2).

Using information from the text/data and your knowledge of economics, evaluate the view that free trade is beneficial to Japan's economy.