Practice 4.1 Benefits of International Trade with authentic IB Economics exam questions for both SL and HL students. This question bank mirrors Paper 1, 2, 3 structure, covering key topics like microeconomics, macroeconomics, and international trade. Get instant solutions, detailed explanations, and build exam confidence with questions in the style of IB examiners.

CASE STUDY: Economic Developments and Challenges in Azerbaijan

-

Azerbaijan, situated at the crossroads of Eastern Europe and Western Asia, has experienced significant economic reforms over the past decade. Historically reliant on hydrocarbons-mainly oil and natural gas—for export revenues, the country has sought to diversify its production base through agriculture, tourism, and technology sectors. In 2019, oil and gas accounted for about 85% of Azerbaijan's total exports, providing substantial government revenue but leaving the country vulnerable to global commodity price fluctuations.

-

In recent years, policymakers have introduced multiple initiatives to modernize infrastructure and reduce dependence on hydrocarbons. Between 2019 and 2022, the government invested over US$3 billion in roads, railways, and energy transmission lines, aiming to expand the country's capacity to produce and transport goods. According to the State Statistical Committee, Azerbaijan's real GDP grew by 2.2% in 2020 and rebounded to 4.6% in 2022, partly due to a recovery in global oil prices. However, structural unemployment persists, especially in rural areas, where older agricultural practices lag behind modern production techniques.

-

Inflation, driven by rising global commodity costs, reached 8.4% in 2022, up from 2.6% in 2019. The Central Bank of Azerbaijan responded with conservative monetary policies that have stabilized the exchange rate of the Azerbaijani manat. Meanwhile, the government introduced tariffs on certain imported agricultural goods in 2021, aiming to protect local farmers from competition and stimulate domestic production. Critics argue that these tariffs lead to higher prices for consumers, while supporters believe they create incentives for farmers to modernize and invest in capital-intensive farming techniques.

-

Foreign direct investment (FDI) centered on the energy sector remains strong, although officials are eager to attract in manufacturing and services. Improvements in transport connectivity-facilitated by ongoing infrastructure projects-have encouraged discussions about further liberalizing trade regulations to boost exports of textiles, food products, and tech services. Yet logistical barriers at border checkpoints persist, contributing to delays and raising costs for exporters looking to access regional markets.

-

Socially, Azerbaijan has implemented targeted measures to address income inequality, including subsidies for utilities and food staples. Observers note that the impact of these subsidies can be uneven; while they help low-income households cope with rising prices, they can also create fiscal pressure if oil revenues decline. The government has recently introduced pilot programs that tie subsidies to specific income thresholds, with the objective of reducing misuse of public funds.

-

Despite ambitious diversification plans, the oil sector continues to dominate. Economic analysts warn that reliance on hydrocarbons could impede sustainable growth, especially if global oil prices weaken or external demand slows. As part of its long-term development strategy, the government is promoting investment in green energy, incentivizing solar and wind power projects in the hope of creating new export opportunities for electricity.

-

Nonetheless, concerns about structural unemployment remain. Skill mismatches persist between job seekers and the needs of modern industries, particularly in the technology sector. Rural-urban migration has become more common, pressuring housing and public services in Baku, while leaving some villages with labor shortages. Recognizing these challenges, the Ministry of Education has partnered with private companies to revamp vocational education programs, aiming to align training with rapidly evolving market demands.

Table 1: Selected Macroeconomic Indicators for Azerbaijan (2019-2022)

| Indicator | 2019 | 2020 | 2021 | 2022 | |

|---|---|---|---|---|---|

| Nominal GDP (US$ billion) | 47.0 | 42.5 | 45.8 | 52.0 | |

| Real GDP Growth Rate (%) | 2.2 | 2.2 | 3.4 | 4.6 | |

| Inflation Rate (%) | 2.6 | 3.0 | 4.5 | 8.4 | |

| Unemployment Rate (%) | 5.3 | 6.5 | 6.2 | 5.9 | |

| Exchange Rate (AZN per US$) | 1.70 | 1.70 | 1.70 | 1.69 | |

| Govt. Capital Spending (US$ billion) | 0.9 | 1.4 | 2.2 | 2.4 |

Table 2: Trade and Social Indicators

| Indicator | 2019 | 2021 | 2022 |

|---|---|---|---|

| Oil/Gas Exports as % of Total Exports | 85% | 85% | |

| Agricultural Tariff Rate (selected products) | 0% | 10% | |

| Gini Coefficient | 0.33 | 0.34 | 0.35 |

| Avg. Monthly Household Subsidy (utilities & food) | US$40 | US$45 | |

| FDI Inflows (US$ billion) | 4.2 | 3.7 | 4.0 |

QUESTIONS

Define the term tariffs indicated in the text (paragraph 3).

Define the term structural unemployment indicated in the text (paragraph 2).

CASE STUDY: Economic Developments and Challenges in Azerbaijan

-

Azerbaijan, situated at the crossroads of Eastern Europe and Western Asia, has experienced significant economic reforms over the past decade. Historically reliant on hydrocarbons-mainly oil and natural gas—for export revenues, the country has sought to diversify its production base through agriculture, tourism, and technology sectors. In 2019, oil and gas accounted for about 85% of Azerbaijan's total exports, providing substantial government revenue but leaving the country vulnerable to global commodity price fluctuations.

-

In recent years, policymakers have introduced multiple initiatives to modernize infrastructure and reduce dependence on hydrocarbons. Between 2019 and 2022, the government invested over US$3 billion in roads, railways, and energy transmission lines, aiming to expand the country's capacity to produce and transport goods. According to the State Statistical Committee, Azerbaijan's real GDP grew by 2.2% in 2020 and rebounded to 4.6% in 2022, partly due to a recovery in global oil prices. However, structural unemployment persists, especially in rural areas, where older agricultural practices lag behind modern production techniques.

-

Inflation, driven by rising global commodity costs, reached 8.4% in 2022, up from 2.6% in 2019. The Central Bank of Azerbaijan responded with conservative monetary policies that have stabilized the exchange rate of the Azerbaijani manat. Meanwhile, the government introduced tariffs on certain imported agricultural goods in 2021, aiming to protect local farmers from competition and stimulate domestic production. Critics argue that these tariffs lead to higher prices for consumers, while supporters believe they create incentives for farmers to modernize and invest in capital-intensive farming techniques.

-

Foreign direct investment (FDI) centered on the energy sector remains strong, although officials are eager to attract in manufacturing and services. Improvements in transport connectivity-facilitated by ongoing infrastructure projects-have encouraged discussions about further liberalizing trade regulations to boost exports of textiles, food products, and tech services. Yet logistical barriers at border checkpoints persist, contributing to delays and raising costs for exporters looking to access regional markets.

-

Socially, Azerbaijan has implemented targeted measures to address income inequality, including subsidies for utilities and food staples. Observers note that the impact of these subsidies can be uneven; while they help low-income households cope with rising prices, they can also create fiscal pressure if oil revenues decline. The government has recently introduced pilot programs that tie subsidies to specific income thresholds, with the objective of reducing misuse of public funds.

-

Despite ambitious diversification plans, the oil sector continues to dominate. Economic analysts warn that reliance on hydrocarbons could impede sustainable growth, especially if global oil prices weaken or external demand slows. As part of its long-term development strategy, the government is promoting investment in green energy, incentivizing solar and wind power projects in the hope of creating new export opportunities for electricity.

-

Nonetheless, concerns about structural unemployment remain. Skill mismatches persist between job seekers and the needs of modern industries, particularly in the technology sector. Rural-urban migration has become more common, pressuring housing and public services in Baku, while leaving some villages with labor shortages. Recognizing these challenges, the Ministry of Education has partnered with private companies to revamp vocational education programs, aiming to align training with rapidly evolving market demands.

Table 1: Selected Macroeconomic Indicators for Azerbaijan (2019-2022)

| Indicator | 2019 | 2020 | 2021 | 2022 | |

|---|---|---|---|---|---|

| Nominal GDP (US$ billion) | 47.0 | 42.5 | 45.8 | 52.0 | |

| Real GDP Growth Rate (%) | 2.2 | 2.2 | 3.4 | 4.6 | |

| Inflation Rate (%) | 2.6 | 3.0 | 4.5 | 8.4 | |

| Unemployment Rate (%) | 5.3 | 6.5 | 6.2 | 5.9 | |

| Exchange Rate (AZN per US$) | 1.70 | 1.70 | 1.70 | 1.69 | |

| Govt. Capital Spending (US$ billion) | 0.9 | 1.4 | 2.2 | 2.4 |

Table 2: Trade and Social Indicators

| Indicator | 2019 | 2021 | 2022 |

|---|---|---|---|

| Oil/Gas Exports as % of Total Exports | 85% | 85% | |

| Agricultural Tariff Rate (selected products) | 0% | 10% | |

| Gini Coefficient | 0.33 | 0.34 | 0.35 |

| Avg. Monthly Household Subsidy (utilities & food) | US$40 | US$45 | |

| FDI Inflows (US$ billion) | 4.2 | 3.7 | 4.0 |

QUESTIONS

Define the term tariffs indicated in the text (paragraph 3).

Define the term structural unemployment indicated in the text (paragraph 2).

Nigeria-Morocco Trade Negotiations

Text A — Background and Economic Overview

Nigeria, located in West Africa, is one of the continent’s largest economies with an estimated GDP of US$450 billion in 2022. It has a population of over 210 million people, and between 2018 and 2022, the average inflation rate rose from 9.3% to 16.9%. The government has responded by tightening monetary policy and increasing spending on infrastructure to stimulate employment and reduce poverty. However, concerns remain about the country’s over-reliance on crude oil exports, which account for more than 85% of export revenue.

Morocco, situated in North Africa, has a more diversified economy, driven by agriculture, phosphates, and tourism. In 2022, Morocco’s GDP stood at approximately US$130 billion, with an annual inflation rate increasing from 1.9% in 2018 to 4.1% in 2022. The country has invested in renewable energy projects to reduce carbon emissions and has also sought to expand its industrial base, particularly in automobile manufacturing.

Text B — The Trade Negotiations

Discussions between Nigeria and Morocco gained momentum in 2021, focusing on developing a new free trade agreement (FTA). Both governments aim to remove or significantly lower tariffs on key exports, foster foreign direct investment (FDI), and align the agreement with Sustainable Development Goals (SDGs). Nigeria, holding an absolute advantage, seeks to reduce tariffs on its crude oil, natural gas, and agricultural goods, while Morocco looks to expand exports of phosphate fertilizers, textiles, and automotive components.

Negotiators also emphasize cooperation in energy, including the possibility of jointly developing a pipeline to carry Nigerian natural gas to Morocco’s Atlantic coast. Leaders from both countries hope this infrastructure project will attract global investors, boost regional trade, and enhance energy security in North and West Africa. Additionally, they intend to facilitate technology transfers and investment in Nigeria’s downstream refining sector, mitigating the region’s vulnerability to volatile oil prices.

Text C — Impact on Local Industries and SDGs

Several domestic industries in both countries have expressed concerns about increased foreign competition. In Nigeria, local manufacturing firms fear that cheaper imports from Morocco could diminish their market share. Meanwhile, Moroccan phosphate producers worry about potential drop-offs in demand if the global market shifts toward renewables and reduces fertilizer consumption. Stakeholders argue that, to remain competitive, companies must innovate and improve production efficiencies.

Both Nigeria and Morocco see the FTA as an opportunity to address issues aligned with the SDGs. Officials highlight SDG 7 (Affordable and Clean Energy), SDG 8 (Decent Work and Economic Growth), and SDG 9 (Industry, Innovation and Infrastructure) as key areas of focus. In Morocco, solar and wind power already account for over 36% of energy generation, and Nigeria aspires to expand its renewable capacity from the current 2% of the energy mix to 10% by 2030. Policymakers believe that increased trade and shared technological expertise could hasten the transition to cleaner energy.

Trade liberalization could contribute to higher economic growth, but it also raises questions about equity. Nigeria’s rural populations depend heavily on agriculture, and the removal of tariffs might expose local farmers to intense foreign competition. In Morocco, labor unions have expressed concerns that cheaper agricultural imports from Nigeria could increase unemployment in the country’s farming regions. Both governments plan to continue negotiating social safeguards, vocational training programs, and targeted subsidies to protect vulnerable groups.

Table 1: Selected Macroeconomic Indicators, 2022

| Indicator | Nigeria | Morocco |

|---|---|---|

| Nominal GDP (US$ billions) | 450 | 130 |

| Inflation Rate (%) | 16.9 | 4.1 |

| Unemployment Rate (%) | 14.2 | 10.5 |

| Currency Exchange Rate (local/US$) | 415.0 | 10.0 |

Table 2: Proposed Tariff Reductions and FDI Projections

| Sector | Proposed Tariff Reduction (%) | Projected FDI Inflows (US$ millions) |

|---|---|---|

| Crude Oil (Nigeria) | 10 → 0 | 450 → 600 |

| Phosphate Fertilizers | 12 → 3 | 270 → 350 |

| Textiles | 15 → 5 | 190 → 250 |

| Automotive Components | 20 → 8 | 300 → 400 |

Define the term inflation indicated in bold (Text A, paragraph 1).

Define the term absolute advantage indicated in bold (Text B, paragraph 3).

Using information from Table 1, calculate the approximate difference in nominal GDP per capita between Nigeria and Morocco.

Sketch an international trade diagram to show how a rise in global demand for crude oil might affect Nigeria’s export revenue (Text A, paragraph 1).

Using an AD/AS diagram, explain how Morocco’s investment in renewable energy (Text C, paragraph 6) could impact its long-run economic growth.

Using an exchange rate diagram, explain the likely effect on Nigeria’s currency if foreign demand for Nigerian crude oil significantly increases (Text C, paragraph 5).

Using an international trade diagram, explain how the reduction of tariffs on Moroccan automotive components might affect local producers in Nigeria (Text B, paragraph 3).

Using an externalities diagram, explain how increased adoption of renewable energy could address negative externalities associated with fossil fuels in Nigeria (Text C, paragraph 6).

Using information from the text/data (including Table 2) and your knowledge of economics, discuss the potential impact of the proposed Nigeria–Morocco trade agreement on both countries meeting two sustainable development goals.

Fiji is an archipelago located in the South Pacific, known for its thriving tourism industry and longstanding sugar sector. Tourism directly and indirectly accounts for nearly 38% of Fiji’s gross domestic product (GDP), making it one of the country’s main sources of foreign exchange. The island nation receives over 800 000 international visitors in a normal (non-pandemic) year, with most tourists arriving from Australia and New Zealand. However, dependence on tourism also makes Fiji vulnerable to external shocks such as global economic downturns or natural disasters.

The sugar industry is the second-largest contributor to Fiji’s export earnings, employing workers in growing, harvesting, and processing sugarcane. Due to changing weather patterns and competition from other sugar-producing nations, sugar production in Fiji faces challenges in expanding supply. In an effort to diversify government revenue, Fiji applies a 9% value added tax (VAT) on domestic sugar sales.

In 2022, the Fijian government announced a 200 million FJD infrastructure investment program aimed at improving rural roads, upgrading port facilities, and modernizing sugar processing plants. Economists estimate Fiji’s marginal propensity to consume (MPC) at 0.75, suggesting a potentially significant boost to aggregate demand if the infrastructure spending is effectively implemented.

Table 1: Key Macroeconomic Indicators for Fiji (2019–2020)

| Indicator | 2019 | 2020 |

|---|---|---|

| Real GDP (FJD millions) | 11 500 | 11 845 |

| Population (thousands) | 889 | 895 |

| Inflation rate (%) | 1.5 | 1.0 |

| Gini coefficient | 0.37 | 0.36 |

Table 2: Sugar Market Data in Fiji

| Year | Price (FJD/ton) | Quantity Demanded (million tons) | Quantity Supplied (million tons) |

|---|---|---|---|

| 2021 | 800 | 1.20 | 1.05 |

| 2022 | 840 | 1.10 | 1.04 |

Additional Information

• Fiji’s VAT on sugar is 9%.

• The government’s total planned infrastructure investment in 2022 is 200 million FJD.

• Economists estimate Fiji’s MPC = 0.75.

• Corporate tax rate is 20%.

• Personal income tax is a progressive system up to 20%.

Using information from Table 2, calculate the price elasticity of demand (PED) for sugar in Fiji when the price increases from 800 FJD per ton in 2021 to 840 FJD per ton in 2022.

Using information from the text above, calculate the total change in real GDP resulting from the government’s 200 million FJD infrastructure investment, given the marginal propensity to consume (MPC) of 0.75.

Using information from Table 1, calculate the real GDP growth rate for Fiji from 2019 to 2020.

Using information from Table 2 and the text above, calculate the total indirect tax (VAT) revenue from sugar sales in 2022.

Define the term “Keynesian multiplier.”

Explain why Fiji’s sugar producers might have a relatively price-inelastic supply in the short run.

Using information from Table 1, calculate the percentage change in Fiji's real GDP per capita between 2019 and 2020. Show your working.

Using data from Table 1, explain how a reduction in the Gini coefficient might benefit Fiji’s long-term economic growth.

Using the text/data provided and knowledge of economics, recommend a policy which could be implemented by the government of Fiji in order to reduce the country’s vulnerability to external shocks arising from tourism and sugar exports.

Explain how international trade can reduce prices for domestic consumers.

Using real-world examples, evaluate the limits of the theory of comparative advantage.

Greenland, an autonomous territory of Denmark, is the world’s largest island with a population of about 56000 people. The economy relies heavily on fisheries (accounting for more than 90% of Greenland’s total exports), public sector services financed through grants from Denmark, and (increasingly) tourism. Recent explorations suggest that Greenland has untapped reserves of minerals and rare earth elements. However, high infrastructure costs and environmental considerations pose challenges to diversification.

Real GDP growth has been volatile due to changes in global demand for fish products and fluctuations in fish prices, while the population faces income inequality concerns. Recent debates in Greenland’s Parliament (Inatsisartut) focus on reforms to taxation and public spending, seeking to foster inclusive economic growth and reduce income disparities.

Table 1: Key Macroeconomic Indicators of Greenland (2018–2021)

| Indicator | 2018 | 2019 | 2020 | 2021 |

|---|---|---|---|---|

| Nominal GDP (bn DKK) | 15.8 | 16.5 | 16.3 | 17.0 |

| Real GDP growth (%) | 2.4 | 3.0 | -1.2 | 2.1 |

| Unemployment rate (%) | 6.2 | 5.5 | 7.1 | 6.4 |

| Gini coefficient | 0.32 | 0.34 | 0.35 | 0.35 |

| Government budget balance (% of GDP) | -2.2 | -1.5 | -4.0 | -3.0 |

Table 2: Fish Exports Data (2019–2021)

| Year | Fish exports (tonnes) | Average price per tonne (DKK) | Estimated PED for Greenlandic halibut |

|---|---|---|---|

| 2019 | 25 000 | 25 000 | -0.8 |

| 2020 | 24 000 | 27 500 | -0.7 |

| 2021 | 27 000 | 28 000 | -0.6 |

Table 3: Income Distribution and Taxation(2021)

| Income group | Share of total population (%) | Average annual income (DKK) | Tax rate (%) |

|---|---|---|---|

| Low-income | 25 | 140 000 | 35 |

| Middle-income | 50 | 250 000 | 40 |

| High-income | 25 | 600 000 | 45 |

Figure 1: Simplified market for Greenlandic Halibut (2021)

Prices are measured in DKK per tonne. Demand (D) and supply (S) represent domestic demand and supply. Pw1 is the initial world price of 28 000 DKK per tonne, while Pw2 is a possible world price of 30 000 DKK per tonne.

Using information from Table 1, calculate Greenland’s approximate nominal GDP per capita for 2021, given that the population was 56 000. Show your workings.

Based on Table 1, calculate Greenland’s average annual real GDP growth rate over the period 2018–2021 (use simple arithmetic mean of the four rates, treating the negative number for 2020 as part of the calculation). Show your workings.

Using the data from Table 2 for 2020 and 2021, calculate the percentage change in total export revenue (in DKK) from Greenlandic halibut.

Refer to Figure 1. Assume the price for Greenlandic halibut rises from Pw1 = 28 000 DKK per tonne to Pw2 = 30 000 DKK per tonne. Using the PED value of -0.6 for 2021, calculate the approximate percentage change in quantity demanded for Greenlandic halibut.

Define the term “progressive tax.”

Using a Keynesian multiplier diagram (AD/AS with an upward sloping AS), explain how an increase in government spending (funded partly by Danish block grants) could affect Greenland’s real GDP in the short run.

Using Table 3, calculate the total income tax paid by the low-income group in Greenland in 2021. Assume the group consists of 25% of the 56 000 population and that everyone earns the average income stated. Show your workings.

Using information from the text and Tables 1 and 3, explain two reasons why persistent inequality (as indicated by the Gini coefficient and tax data) could be harmful to Greenland’s long-term economic growth.

Using the text/data provided and your knowledge of economics, recommend a policy which could be implemented by Greenland’s Parliament in order to reduce income inequality and support long-term economic growth. Justify your recommendation.

Overvaluation of the NZD

New Zealand’s strong economic performance has led to a surge in the value of its currency, the New Zealand dollar (NZD). The finance minister has expressed concern that the NZD is overvalued by 10–15%, potentially impacting the country’s export sector by making its goods and services more expensive for foreign buyers.

Despite the strong currency, New Zealand’s export sector has demonstrated resilience, adapting to the challenging environment. However, the Reserve Bank of New Zealand (RBNZ) has taken steps to curb inflationary pressures and maintain economic stability. The central bank has raised interest rates four times this year, reaching 3.5%. This tightening of monetary policy aims to keep inflation expectations in check and ensure sustainable economic expansion.

New Zealand’s economy is projected to grow at a robust 3.7% in 2014. The country has also achieved a trade surplus, driven by strong global demand for its dairy products. However, recent declines in dairy prices have moderated export growth, as New Zealand’s dairy exports are a key contributor to the economy.

To address the overvalued currency, the central bank may consider intervening in the foreign exchange market to induce a depreciation of the NZD. A weaker NZD would boost exports by making them more competitive internationally and reduce inflationary pressures caused by expensive imports. By carefully managing monetary policy, the Reserve Bank aims to strike a balance between supporting economic growth and maintaining price stability.

The NZD had been near its record high against the US dollar before weakening last week due to slower inflation figures and a fall in dairy prices. The NZD has gained about 6% so far this year.

An economist recently suggested that the central bank might intervene in the currency market to prevent further appreciation of the NZD.

New Zealand government figures showed a monthly trade (goods) surplus of NZD 247 million in June 2014, compared to NZD 371 million in June 2013. The annual trade (goods) balance shifted to a surplus of NZD 1.2 billion from a deficit of NZD 819 million a year earlier.

Global demand for New Zealand dairy products has been a key support for exports over the past 18 months, though prices have dropped this year due to an increase in global supply.

Table 1: New Zealand’s Trade Data

| Year | Exports (NZD billion) | Imports (NZD billion) | Trade Balance (NZD billion) |

|---|---|---|---|

| 2013 | 48.2 | 49.0 | ? |

| 2014 | 50.5 | 49.3 | ? |

Table 2: NZD Exchange Rate and Dairy Price Index

| Year | NZD/USD Exchange Rate | Dairy Price Index (Base = 100) |

|---|---|---|

| 2013 | 0.78 | 120 |

| 2014 | 0.85 | 102 |

Define the term exchange rate.

List two possible reasons why a country might experience an overvalued currency.

Using information from Table 1, calculate the percentage change in New Zealand’s trade balance from 2013 to 2014.

Using a supply and demand diagram, draw the impact of a strong NZD on the demand for New Zealand’s exports.

Using an exchange rate diagram, explain how an intervention by the Reserve Bank to weaken the NZD could affect the exchange rate.

Using Table 2 and information from the text, explain how falling prices of dairy products affect the exchange rate of NZD

Using an interest rate diagram, explain how an increase in interest rates can help control inflation.

Using an AD-AS diagram, explain the possible impact of a trade surplus on New Zealand’s economic growth.

Using information from the text/data and your knowledge of economics, evaluate the effects of New Zealand’s overvalued currency on its economic growth and/or development.

Current account deficit poses a challenge to Pakistan’s economy

Pakistan’s president has raised concerns about the increasing current account deficit, which grew to USD 12.12 billion in 2016/17 from USD 4.86 billion in 2015/16. This deficit is driven by rising imports and declining exports. Due to low prices of the imported goods in foreign markets, the president has proposed restricting the import of luxury, non-essential goods through quotas, aiming to mitigate the issue and reduce dependence on external borrowing.

The governor of Pakistan’s central bank supports the president’s concern, emphasizing that excessive non-essential imports contribute to the deficit and require borrowing from abroad. However, he noted that 32% of imports consist of capital goods essential for the growth of small and medium enterprises (SMEs), agriculture, and construction.

Central bank advisors have suggested depreciating the rupee to address the trade deficit. The currency operates under a managed exchange rate system and is estimated to be overvalued by 20%. However, the central bank governor warns of the negative effects of depreciation, such as higher inflation.

Pakistan’s economic growth reached 5.3% in 2016, its highest in a decade, with an estimated increase to 6% in 2017. The government believes that boosting SME loans from 7-8% to 15-17% of total business loans will further enhance economic growth.

In addition to the current account deficit, fiscal policy decisions have led to a budget deficit, increasing public debt to 62% of GDP in 2016. The central bank recommends limiting public debt to 60% of GDP.

Table 1: Pakistan’s Current Account Data

| Year | Exports (US$ billion) | Imports (US$ billion) | Current Account Deficit (US$ billion) |

|---|---|---|---|

| 2015/16 | 22.0 | 26.86 | 4.86 |

| 2016/17 | 21.5 | 33.62 | 12.12 |

Table 2: Key Economic Indicators

| Year | GDP Growth Rate (%) | SME Loans (% of total business loans) | Public Debt (% of GDP) | Rupee Overvaluation (%) |

|---|---|---|---|---|

| 2016 | 5.3 | 7.5 | 62 | 20 |

| 2017 | 6.0 | 8.0 | 65 | 18 |

Define the term "current account".

List two fiscal policy measures.

Using information from Table 1, calculate the percentage increase in Pakistan’s current account deficit from 2015/16 to 2016/17.

Draw a diagram to show the effect of a low price of foreign goods on the quantity imported by Pakistan.

Using an exchange rate diagram, explain how a depreciation of the rupee could impact Pakistan’s trade balance.

Using an AD/AS diagram, explain how an increase in government debt could affect economic growth.

Using a demand and supply diagram, explain how restricting luxury imports may affect domestic production in Pakistan.

Using information from the text/data and your knowledge of economics, evaluate Pakistan's current measures effectiveness in achieving long-run economic growth and/or development.

Northland Free Trade Agreement

Northland is a landlocked developing country of 5 million people. Despite agriculture employing 60% of the labor force, the sector contributes only 25% to GDP, highlighting significant productivity challenges. The country's trade profile reflects this economic structure, with exports concentrated in primary products like coffee, tea, and textiles, while relying heavily on imports of machinery, oil, and processed foods, resulting in a persistent annual trade deficit of $1 billion.

In response to growing concerns about import dependency and the need to protect domestic industries, Northland's government initially implemented substantial tariffs on processed food imports. This protection policy aimed to nurture local food processing capabilities and reduce the trade deficit. However, while these measures provided some shelter for domestic producers, they also resulted in higher consumer prices and limited market competition.

Recently, Northland has taken a significant step by signing a free trade agreement (FTA) with a neighboring country, marking a shift from protectionist policies toward regional integration. This move presents both opportunities and challenges: while it promises improved market access for Northland's exports and potential technology transfer through increased regional trade, it also exposes local producers to stronger competition. However, to maintain domestic standards of living in face of fear of machinery replacing jobs, the Northland's government has imposed a minimum wage. The success of these policy shifts will largely depend on how well Northland's agricultural sector can adapt to new market pressures while leveraging its traditional export strengths.

Table 1: Northland's Trade Data Before and After FTA

| Year | Exports (US$ billion) | Imports (US$ billion) | Trade Deficit (US$ billion) |

|---|---|---|---|

| 2021 | 2.5 | 3.5 | 1.0 |

| 2023 | 3.2 | 3.8 | 0.6 |

Table 2: Price Elasticities of Demand for Northland’s Key Exports and Imports

| Product | PED | PES |

|---|---|---|

| Coffee | -0.6 | 0.4 |

| Tea | -0.8 | 0.6 |

| Textiles | -1.2 | 1.0 |

| Machinery (imported) | -0.3 | 0.2 |

| Processed food (imported) | -0.9 | 0.7 |

Define the term free trade.

List two types of trade barriers that governments can impose.

Using information from Table 1, calculate the percentage change in Northland’s trade deficit from 2021 to 2023.

Draw a diagram to show the effect of a tariff on processed food imports before the FTA.

Using a tariff diagram, explain how the removal of tariffs on processed food might affect consumption in Northland.

Using a comparative advantage diagram, explain how the FTA could improve Northland’s export competitiveness.

Using a free trade diagram, explain how increased imports could impact Northland’s domestic food processing industry.

Using a labour market diagram, explain how the imposition of a minimum wage might lead to structural unemployment in Northland’s agricultural sector.

Using information from the text/data and your knowledge of economics, evaluate the potential impact of price elasticities on Northland’s trade balance.

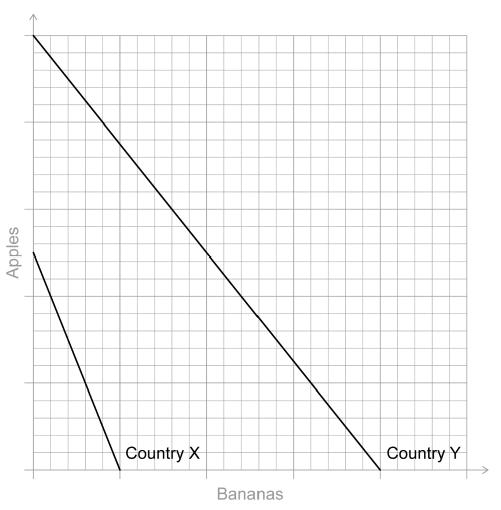

Country X and Country Y are capable of producing both apples and bananas. Assume a two-country, two-product model.

Country Y has absolute advantage in the production of both apples and bananas, and comparative advantage in the production of bananas.

The market for oranges in Country Z is illustrated on Figure 5.

Figure 5

The domestic demand and supply for oranges are given by the functions

Qd = 300 − 100_P_

Qs = − 60 + 60_P_

where P is the price of oranges in dollars per kilogram ($ per kg), Qd is the quantity of oranges demanded (thousands of kg per month) and Qs is the quantity of oranges supplied (thousands of kg per month). The world price of oranges is $2 per kg.

Due to increased awareness of the possible health benefits of vitamin C, the demand for oranges in Country Z increases by 60 000 per month at each price.

Tanya is a currency speculator. She buys and sells currencies with the intention of making gains as a result of changes in the exchange values of currencies. Currently, she is holding US$300 000, but she expects that in the next few months the euro (EU€) (the currency of the eurozone) will appreciate against the US dollar (US$).

At present, EU€1 = US$1.20.

Tanya exchanges her US$ for EU€.

The EU€ depreciates by 10 % against the US$. Fearing further depreciation of the EU€, Tanya exchanges her EU€ for US$.

Sketch and label a diagram to illustrate comparative advantage between Country X and Country Y on Figure 4.

Figure 4

Outline the reason why Country X should specialize in the production of apples and Country Y should specialize in the production of bananas.

Outline one reason why it might not be in a country’s best interests to specialize according to the principle of comparative advantage.

Calculate the change in expenditure on imported oranges as a result of the increase in demand.

Calculate the change in consumer surplus in Country Z as a result of the increase in demand for oranges.

Calculate the change in social (community) surplus as a result of the increase in demand for oranges.

State one administrative barrier that Country Z could use in order to restrict imports.

Explain two possible economic consequences for the eurozone if the euro appreciates.

Calculate the quantity of EU€ she will receive for her US$300 000.

Calculate, in US$, the loss made by Tanya as a result of these transactions.

Explain two reasons why a government might prefer a floating exchange rate system for its currency.