Practice 4.2 Types of Trade Protection with authentic IB Economics exam questions for both SL and HL students. This question bank mirrors Paper 1, 2, 3 structure, covering key topics like microeconomics, macroeconomics, and international trade. Get instant solutions, detailed explanations, and build exam confidence with questions in the style of IB examiners.

Albania is a country in Southeastern Europe with an estimated population of about 2.8 million in 2022. The Albanian economy has been transitioning from a centrally planned system to a market-based system and has experienced positive real GDP growth in recent years. Tourism is a significant contributor to Albania’s GDP, and the government has intensified efforts to promote the country’s attractions along its Adriatic and Ionian coasts.

In 2022, Albania’s unemployment rate was around 12%, partly due to structural challenges in the economy. The government operates a progressive personal income tax system, with rates ranging from 0% up to 23%. Corporate income tax is set at 15%. Value-added tax (VAT) on most goods and services stands at 20%.

Albania’s trade balance remains negative, as the country’s main exports (textiles, footwear, and mineral fuels) have not kept pace with imports (machinery, food, and manufactured goods). The government has embarked on several infrastructural projects to attract foreign investment and reduce transport costs, including a newly announced US$200 million investment in highways. Economists estimate the marginal propensity to consume (MPC) in Albania to be about 0.8.

Table 1: Selected Macroeconomic Indicators for Albania

| Year | Real GDP (billion US$) | Unemployment Rate (%) | Gini Coefficient |

|---|---|---|---|

| 2021 | 15.2 | 11.5 | 0.30 |

| 2022 | 16.0 | 12.0 | 0.31 |

Table 2: Tourism Data in Albania (2022)

| Price per Tour Package (EUR) | Quantity Demanded of Tour Packages (thousands) |

|---|---|

| 400 | 140 |

| 450 | 120 |

Using the information provided in Table 1, calculate the percentage change in Albania’s real GDP between 2021 and 2022.

The Albanian government’s US$200 million highway project is expected to raise national income through the Keynesian multiplier, assuming the marginal propensity to consume (MPC) is 0.8. Calculate the total increase in national income that could result from this project.

Using the data in Table 2, calculate the price elasticity of demand (PED) for Albania’s tour packages when the price increases from EUR 400 to EUR 450.

Using the data in Table 1, calculate the absolute change in the unemployment rate between 2021 and 2022.

Define the term “progressive tax.”

Using an AD/AS diagram, explain how an increase in government spending on infrastructure could affect real GDP in Albania.

Using information from Table 1, calculate the approximate percentage change in Albania's Gini coefficient between 2021 and 2022. Show your working.

Using information from the text, explain how a persistent trade deficit might impact Albania’s economic growth.

Using the text/data provided and your knowledge of economics, recommend a policy which the government of Albania could implement in order to reduce unemployment.

Guatemala is a Central American country with an estimated population of 17.9 million (2022). According to World Bank data, real GDP was approximately US$85 billion in 2022. Agriculture, particularly coffee, sugar, and bananas, makes up a significant portion of Guatemala’s exports (around 28% of total exports). While the tourism sector has been expanding, recent global events caused slowdowns. The country experiences persistent inequality, with a Gini coefficient estimated at about 0.48 in 2021. Poverty remains a major concern, especially in rural areas.

Guatemala’s tax system includes both direct and indirect taxes, although collection remains challenging. Personal income tax rates are progressive, with a top rate of 31%, while the corporate income tax rate is 25%. A value-added tax (VAT) of 12% applies to most goods. Government spending has focused on infrastructure and social programs to reduce poverty and increase potential long-term growth.

Table 1: Macroeconomic Indicators of Guatemala (2019–2022)

| Year | Real GDP (US$ bn) | Nominal GDP (US$ bn) | Exports of Goods & Services (US$ bn) | Government Spending (US$ bn) |

|---|---|---|---|---|

| 2019 | 76.0 | 78.2 | 11.5 | 11.8 |

| 2020 | 73.5 | 75.0 | 10.2 | 12.1 |

| 2021 | 78.4 | 81.0 | 12.4 | 12.3 |

| 2022 | 85.0 | 88.0 | 13.5 | 13.2 |

Table 2: Income Distribution in Guatemala (2021)

| Quintile | Income share |

|---|---|

| 1 (lowest 20%) | 4.1% |

| 2 | 9.0% |

| 3 | 15.0% |

| 4 | 24.0% |

| 5 (highest 20%) | 47.9% |

Table 3: Market for Guatemalan Coffee in the US (price per 50 kg bag)

| Price per 50 kg bag | Quantity Demanded (tons) | Quantity Supplied (tons) |

|---|---|---|

| $110 | 900 | 550 |

| $120 | 850 | 600 |

| $130 | 800 | 650 |

| $140 | 750 | 700 |

| $150 | 700 | 740 |

Table 4: Tax Rates in Guatemala

| Type of tax | Rate of tax |

|---|---|

| Corporate income tax | 25% |

| Personal income tax | Progressive up to 31% |

| Value Added Tax (VAT) | 12% on most goods; some items taxed at 0% |

Figure 1 (not drawn here) shows that, when government spending in Guatemala increases by US$1 billion, real GDP rises by an estimated US$2.5 billion. This suggests a government spending multiplier of 2.5.

Using the information in Table 1, calculate the real GDP growth rate from 2021 to 2022.

Using Figure 1, the government spending rises by US$1 billion, yet real GDP rises by US$2.5 billion. Calculate the government spending multiplier and explain the main step used in your calculation.

Using the information in Table 3, calculate the price elasticity of demand (PED) for Guatemalan coffee when the price rises from US$120 to US$130 per 50 kg bag.

Using the information in Table 3, calculate the price elasticity of supply (PES) for Guatemalan coffee when the price increases from US$140 to US$150 per 50 kg bag.

Define the term “progressive tax.”

Using an AD/AS diagram, explain how an increase in government spending might increase real GDP and reduce unemployment in Guatemala.

Using the data in Table 3, calculate the approximate equilibrium price for Guatemalan coffee. Show your working.

Using information from Table 2, explain two ways in which high income inequality might hamper economic development in Guatemala.

Using the text/data provided and knowledge of economics, recommend a policy that the government of Guatemala could implement to reduce income inequality. Justify the recommendation.

CASE STUDY: Economic Developments and Challenges in Azerbaijan

-

Azerbaijan, situated at the crossroads of Eastern Europe and Western Asia, has experienced significant economic reforms over the past decade. Historically reliant on hydrocarbons-mainly oil and natural gas—for export revenues, the country has sought to diversify its production base through agriculture, tourism, and technology sectors. In 2019, oil and gas accounted for about 85% of Azerbaijan's total exports, providing substantial government revenue but leaving the country vulnerable to global commodity price fluctuations.

-

In recent years, policymakers have introduced multiple initiatives to modernize infrastructure and reduce dependence on hydrocarbons. Between 2019 and 2022, the government invested over US$3 billion in roads, railways, and energy transmission lines, aiming to expand the country's capacity to produce and transport goods. According to the State Statistical Committee, Azerbaijan's real GDP grew by 2.2% in 2020 and rebounded to 4.6% in 2022, partly due to a recovery in global oil prices. However, structural unemployment persists, especially in rural areas, where older agricultural practices lag behind modern production techniques.

-

Inflation, driven by rising global commodity costs, reached 8.4% in 2022, up from 2.6% in 2019. The Central Bank of Azerbaijan responded with conservative monetary policies that have stabilized the exchange rate of the Azerbaijani manat. Meanwhile, the government introduced tariffs on certain imported agricultural goods in 2021, aiming to protect local farmers from competition and stimulate domestic production. Critics argue that these tariffs lead to higher prices for consumers, while supporters believe they create incentives for farmers to modernize and invest in capital-intensive farming techniques.

-

Foreign direct investment (FDI) centered on the energy sector remains strong, although officials are eager to attract in manufacturing and services. Improvements in transport connectivity-facilitated by ongoing infrastructure projects-have encouraged discussions about further liberalizing trade regulations to boost exports of textiles, food products, and tech services. Yet logistical barriers at border checkpoints persist, contributing to delays and raising costs for exporters looking to access regional markets.

-

Socially, Azerbaijan has implemented targeted measures to address income inequality, including subsidies for utilities and food staples. Observers note that the impact of these subsidies can be uneven; while they help low-income households cope with rising prices, they can also create fiscal pressure if oil revenues decline. The government has recently introduced pilot programs that tie subsidies to specific income thresholds, with the objective of reducing misuse of public funds.

-

Despite ambitious diversification plans, the oil sector continues to dominate. Economic analysts warn that reliance on hydrocarbons could impede sustainable growth, especially if global oil prices weaken or external demand slows. As part of its long-term development strategy, the government is promoting investment in green energy, incentivizing solar and wind power projects in the hope of creating new export opportunities for electricity.

-

Nonetheless, concerns about structural unemployment remain. Skill mismatches persist between job seekers and the needs of modern industries, particularly in the technology sector. Rural-urban migration has become more common, pressuring housing and public services in Baku, while leaving some villages with labor shortages. Recognizing these challenges, the Ministry of Education has partnered with private companies to revamp vocational education programs, aiming to align training with rapidly evolving market demands.

Table 1: Selected Macroeconomic Indicators for Azerbaijan (2019-2022)

| Indicator | 2019 | 2020 | 2021 | 2022 | |

|---|---|---|---|---|---|

| Nominal GDP (US$ billion) | 47.0 | 42.5 | 45.8 | 52.0 | |

| Real GDP Growth Rate (%) | 2.2 | 2.2 | 3.4 | 4.6 | |

| Inflation Rate (%) | 2.6 | 3.0 | 4.5 | 8.4 | |

| Unemployment Rate (%) | 5.3 | 6.5 | 6.2 | 5.9 | |

| Exchange Rate (AZN per US$) | 1.70 | 1.70 | 1.70 | 1.69 | |

| Govt. Capital Spending (US$ billion) | 0.9 | 1.4 | 2.2 | 2.4 |

Table 2: Trade and Social Indicators

| Indicator | 2019 | 2021 | 2022 |

|---|---|---|---|

| Oil/Gas Exports as % of Total Exports | 85% | 85% | |

| Agricultural Tariff Rate (selected products) | 0% | 10% | |

| Gini Coefficient | 0.33 | 0.34 | 0.35 |

| Avg. Monthly Household Subsidy (utilities & food) | US$40 | US$45 | |

| FDI Inflows (US$ billion) | 4.2 | 3.7 | 4.0 |

QUESTIONS

Define the term tariffs indicated in the text (paragraph 3).

Define the term structural unemployment indicated in the text (paragraph 2).

Estonia is a small Baltic nation of approximately 1.3 million people and a member of the European Union (EU). Its economy is characterized by a highly developed digital infrastructure, a strong commitment to innovation, and comparatively low public debt. The country has seen notable growth in service sectors such as tourism and information technology (IT). Estonia is also known for its relatively low level of corruption and ease of doing business.

In recent years, Estonia’s GDP growth has fluctuated. Between 2018 and 2019, real GDP grew steadily due to robust exports of IT services and growth in inbound tourism. However, the global economic slowdown in 2020 led to lower tourism revenues, affecting the country’s overall economic performance. Income inequality has been an area of focus for policymakers, given Estonia’s Gini coefficient has been moderate but slowly increasing. The government maintains several forms of taxation (including VAT, personal income tax, and corporate taxation), each contributing differently to government revenue.

Tourism is an important source of income, especially from visitors from Finland, Russia, and other EU countries. Average spending per tourist has tended to rise, but so have accommodation and transportation costs. The price elasticity of demand for inbound tourism is not negligible, as changes in travel costs and exchange rates influence tourist flows.

Estonia’s taxation system includes a flat personal income tax rate of 20%, although there are discussions about introducing progressive elements. VAT rates vary depending on the product category. Meanwhile, the government has contemplated expansionary fiscal measures to offset slower growth periods. Policymakers also debate the efficacy of supply-side policies (such as reducing labor taxes and encouraging business start-ups) to maintain Estonia’s competitiveness in the global digital economy.

Table 1: Selected Macroeconomic Indicators for Estonia (2018–2021)

| Indicator | 2018 | 2019 | 2020 | 2021 |

|---|---|---|---|---|

| Real GDP (billion euros) | 26.0 | 27.2 | 26.5 | 29.0 |

| Real GDP Growth Rate (%) | 4.5 | 4.3 | -2.9 | 8.2 |

| Unemployment Rate (%) | 5.4 | 4.4 | 6.8 | 6.0 |

| Gini Coefficient | 0.31 | 0.32 | 0.33 | 0.34 |

Table 2: Estimated Demand for Inbound Tourism (annual)

| Average Price per Trip (euros) | Quantity of Trips Demanded (thousands) |

|---|---|

| 300 | 325 |

| 330 | 280 |

Table 3: Government Tax Data (2021)

| Type of Tax | Rate | Annual Revenue (million euros) |

|---|---|---|

| Personal Income Tax | 20% (flat) | 1,880 |

| Corporate Tax | 20% on distributed profit | 800 |

| Value-Added Tax (VAT) | Standard rate: 20% | 2,200 |

Table 4: Consumption and Multiplier Data (2021)

| Aggregate Income (Y) (billion euros) | Marginal Propensity to Consume (MPC) |

|---|---|

| 28.0 | 0.75 |

Using information from Table 2, calculate the price elasticity of demand for inbound tourism in Estonia when the average price per trip increases from €300 to €330.

Using the data in Table 1, calculate Estonia’s average annual real GDP growth rate over the period 2018 to 2021. Show all your working.

Using information from Table 1, calculate the percentage change in the Gini coefficient from 2018 to 2021.

Using Table 4, calculate the Keynesian (simple) multiplier for Estonia.

Define the term “progressive tax.”

Using an AD/AS diagram, explain how a significant increase in Estonia’s IT services exports might affect real GDP and the price level in the short run.

Using the data from Table 3, calculate what percentage of Estonia's total tax revenue comes from personal income tax. Show your working.

Using information from the text and Table 1, explain two ways in which Estonia’s rising income inequality could affect its long-term economic development.

Using the text/data provided and your knowledge of economics, recommend a policy that the Estonian government could implement to maintain strong economic growth while addressing rising income inequality.

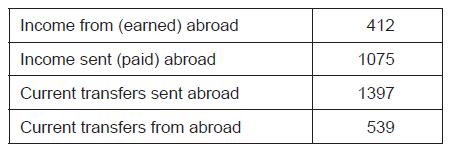

Table 5 shows selected items of the balance of payments for Laylaland in 2020. Figures are in millions of US dollars (US$).

Table 5

Laylaland has a current account deficit of US$1865 million.

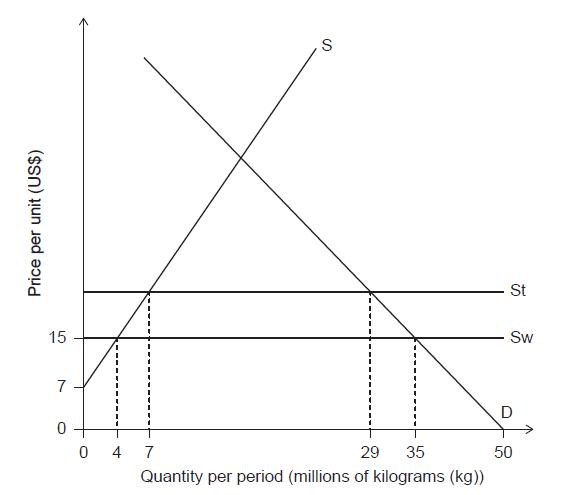

Chia seeds are an agricultural good produced in many countries and priced in US dollars (US$).

Figure 1 illustrates the market for chia seeds in a small country called Nofiberland. D is the domestic demand and S is the domestic supply for chia seeds. Chia seeds can be initially imported at the current world price of US$15.00 per kg. Sw is therefore the world supply faced in Nofiberland with free trade. To protect Nofiberland producers, the government decides to impose a US$6.00 tariff on chia seed imports. St is therefore the world supply faced in Nofiberland after the tariff is imposed.

Figure 1

Quinoa is a great source of protein and is thus considered a “super food”. As a result, the demand for quinoa in advanced economies has lately been rising very fast while global supply has not changed. A small country called Proteinland gets 80 % of its export revenues from exporting quinoa to advanced economies.

Distinguish between credit and debit items in the balance of payments.

State one example of a debit item from the financial account of the balance of payments.

Using Table 5, calculate the value of net current transfers for Laylaland in 2020.

Using Table 5, calculate the net exports of goods and services for Laylaland in 2020.

Explain two methods that Laylaland’s government could use to correct the current account deficit.

List two administrative barriers that Nofiberland could have used to limit imports of chia seeds.

Calculate the price elasticity of demand for chia seeds in Nofiberland following the imposition of the tariff.

Calculate the change in consumer expenditure on imported chia seeds in Nofiberland resulting from the imposition of the tariff.

Calculate the total welfare loss resulting from the imposition of the tariff on chia seeds.

Outline one reason why the imposition of the tariff would lead to a welfare loss.

Describe the impact of the rise in demand for quinoa on the terms of trade of Proteinland.

Explain how the increase in world demand for quinoa would likely affect the current account balance of Proteinland.

Denmark is a highly developed economy in Northern Europe with a population of about 5.9 million. It boasts one of the highest standards of living in the world, supported by a broad-based welfare system and progressive taxation. The service sector, advanced manufacturing, and renewable-energy technology form key parts of its economy. Denmark’s central bank has maintained low interest rates, helping to foster economic stability. However, challenges such as ensuring long-term sustainability of the welfare system and addressing potential future energy shortfalls remain.

Exports are crucial for Denmark’s economic success, with wind turbines, pharmaceuticals, and meat products contributing significantly to export revenues. Wind turbine manufacturers in Denmark have become global leaders, but recent shifts in global demand and competition from Asian producers have tested the capacity of local firms. Meanwhile, a high rate of personal and corporate income tax has provided funds for extensive public expenditure, including education, healthcare, and infrastructure.

Table 1: Selected Macroeconomic Indicators for Denmark (2022–2023)

| Indicator | 2022 | 2023 (est.) |

|---|---|---|

| Nominal GDP (billion DKK) | 2,350 | 2,485 |

| Real GDP growth rate (%) | 2.1 | 3.0 |

| Inflation rate (%) | 5.5 | 2.8 |

| Unemployment rate (%) | 4.5 | 4.2 |

| Government spending (billion DKK) | 860 | 920 |

| Marginal propensity to consume (MPC) | 0.8 | 0.8 |

| Gini coefficient (after taxes/transfers) | 0.27 | 0.26 |

Table 2: Market for Wind Turbines Produced in Denmark

| Price per turbine (DKK) | Quantity Demanded (units per year) | Quantity Supplied (units per year) |

|---|---|---|

| 10,000,000 | 100 | 60 |

| 11,000,000 | 90 | 65 |

| 12,000,000 | 84 | 68 |

| 15,000,000 | 75 | 72 |

Table 3: Income Distribution in Denmark (2022)

| Income Group | Income Range (DKK/year) | Proportion of Households (%) |

|---|---|---|

| Lowest 20 % | 0 – 240,000 | 20 |

| Second 20 % | 240,001 – 400,000 | 20 |

| Third 20 % | 400,001 – 600,000 | 20 |

| Fourth 20 % | 600,001 – 850,000 | 20 |

| Highest 20 % | Above 850,000 | 20 |

Table 4: Overview of Tax Rates in Denmark

| Tax Category | Rate (% of taxable income / value) |

|---|---|

| Corporate income tax | 22 |

| Top personal income tax | 52 |

| Standard VAT rate | 25 |

| Reduced VAT rate | 15 |

In 2023, an energy-infrastructure firm in Denmark is planning a major investment worth 1.2 billion DKK, and claims it could significantly boost the economy by generating additional consumption expenditures.

Wind Turbine Exports

Denmark exported 70 units of wind turbines at an average price of 11,000,000 DKK per unit to other European countries in 2022. Owing to rising demand for renewable energy worldwide, the price of wind turbines exported from Denmark is expected to rise from 11,000,000 DKK to 12,000,000 DKK per unit in 2023. However, global competition from producers in Asia might cause changes in the quantity demanded.

Using information from Table 1, calculate the real GDP growth (in billion DKK) from 2022 to 2023 for Denmark.

Based on Table 2, estimate the price elasticity of supply (PES) for wind turbines in Denmark when the price increases from 11,000,000 DKK to 12,000,000 DKK per turbine.

Using information from the text, calculate the change in the total value of Denmark’s wind turbine exports when the price rises from 11,000,000 DKK to 12,000,000 DKK per unit, assuming the quantity exported remains constant at 70 units.

Using the data from Table 3, calculate what proportion of total households earn above 400,000 DKK per year. [

Define the term “Keynesian multiplier.”

Using an aggregate demand and aggregate supply (AD/AS) diagram, explain how the planned 1.2 billion DKK infrastructure investment by the energy-infrastructure firm could affect real output and the price level in Denmark.

Using information from Table 4, calculate the corporate income tax that would be paid by a Danish company with taxable profits of 50 million DKK. Show your working.

Using information from the text and Table 4, explain one way in which Denmark’s progressive tax system (top personal tax rate of 52 %) may help reduce income inequality.

Using the text/data provided and knowledge of economics, recommend a policy that the government of Denmark could implement to increase its long-term economic growth, while ensuring external competitiveness.

Fiji is an archipelago located in the South Pacific, known for its thriving tourism industry and longstanding sugar sector. Tourism directly and indirectly accounts for nearly 38% of Fiji’s gross domestic product (GDP), making it one of the country’s main sources of foreign exchange. The island nation receives over 800 000 international visitors in a normal (non-pandemic) year, with most tourists arriving from Australia and New Zealand. However, dependence on tourism also makes Fiji vulnerable to external shocks such as global economic downturns or natural disasters.

The sugar industry is the second-largest contributor to Fiji’s export earnings, employing workers in growing, harvesting, and processing sugarcane. Due to changing weather patterns and competition from other sugar-producing nations, sugar production in Fiji faces challenges in expanding supply. In an effort to diversify government revenue, Fiji applies a 9% value added tax (VAT) on domestic sugar sales.

In 2022, the Fijian government announced a 200 million FJD infrastructure investment program aimed at improving rural roads, upgrading port facilities, and modernizing sugar processing plants. Economists estimate Fiji’s marginal propensity to consume (MPC) at 0.75, suggesting a potentially significant boost to aggregate demand if the infrastructure spending is effectively implemented.

Table 1: Key Macroeconomic Indicators for Fiji (2019–2020)

| Indicator | 2019 | 2020 |

|---|---|---|

| Real GDP (FJD millions) | 11 500 | 11 845 |

| Population (thousands) | 889 | 895 |

| Inflation rate (%) | 1.5 | 1.0 |

| Gini coefficient | 0.37 | 0.36 |

Table 2: Sugar Market Data in Fiji

| Year | Price (FJD/ton) | Quantity Demanded (million tons) | Quantity Supplied (million tons) |

|---|---|---|---|

| 2021 | 800 | 1.20 | 1.05 |

| 2022 | 840 | 1.10 | 1.04 |

Additional Information

• Fiji’s VAT on sugar is 9%.

• The government’s total planned infrastructure investment in 2022 is 200 million FJD.

• Economists estimate Fiji’s MPC = 0.75.

• Corporate tax rate is 20%.

• Personal income tax is a progressive system up to 20%.

Using information from Table 2, calculate the price elasticity of demand (PED) for sugar in Fiji when the price increases from 800 FJD per ton in 2021 to 840 FJD per ton in 2022.

Using information from the text above, calculate the total change in real GDP resulting from the government’s 200 million FJD infrastructure investment, given the marginal propensity to consume (MPC) of 0.75.

Using information from Table 1, calculate the real GDP growth rate for Fiji from 2019 to 2020.

Using information from Table 2 and the text above, calculate the total indirect tax (VAT) revenue from sugar sales in 2022.

Define the term “Keynesian multiplier.”

Explain why Fiji’s sugar producers might have a relatively price-inelastic supply in the short run.

Using information from Table 1, calculate the percentage change in Fiji's real GDP per capita between 2019 and 2020. Show your working.

Using data from Table 1, explain how a reduction in the Gini coefficient might benefit Fiji’s long-term economic growth.

Using the text/data provided and knowledge of economics, recommend a policy which could be implemented by the government of Fiji in order to reduce the country’s vulnerability to external shocks arising from tourism and sugar exports.

Estonia is a small, high-income European country with a population of around 1.33 million. The Estonian economy is highly open, with exports accounting for a large share of its GDP. In 2021, Estonia’s real GDP was approximately €34.5 billion, growing by 8.0%, while the 2022 figure rose to €36.4 billion, with real GDP growth of 3.5%. Over the same period, the unemployment rate declined from 6.2% to 5.6%.

Estonia is known for its advanced digital infrastructure, which has attracted investment in technology and services. However, inflation surged in 2022 due to global supply pressures and increased energy prices. Estonia has a relatively low level of income inequality compared to many countries, as measured by its Gini coefficient, which improved slightly from 0.31 in 2021 to around 0.30 in 2022.

Estonia’s tax system is characterized by a flat personal income tax rate of 20% and a 20% corporate tax on distributed profits. The government also raises revenue through value-added tax (VAT) at 20%, excise duties, and social security contributions of 33%. The timber industry plays a significant role in Estonian exports; higher prices for timber have contributed to fluctuations in export earnings.

Below are three tables presenting selected data for the Estonian economy:

Table 1: Selected Macroeconomic Indicators for Estonia (2021–2022)

| Indicator | 2021 | 2022 |

|---|---|---|

| Real GDP (EUR billions) | 34.5 | 36.4 |

| Real GDP growth rate (%) | 8.0 | 3.5 |

| Unemployment rate (%) | 6.2 | 5.6 |

| Inflation (%) | 4.5 | 18.8 |

| Gini coefficient (estimate) | 0.31 | 0.30 |

Table 2: Timber Market Data in Estonia

| Price (EUR/m³) | Quantity Demanded (million m³) |

|---|---|

| 120 | 2.6 |

| 140 | 2.3 |

Table 3: Tax Revenue in Estonia (2022)

| Tax Type | Rate (%) | Annual Revenue (EUR million) |

|---|---|---|

| Personal income tax | 20 | 2,000 |

| Corporate tax (on distributed profits) | 20 | 800 |

| VAT | 20 | 3,200 |

| Excise taxes (alcohol, tobacco, fuel) | Varies | 1,500 |

| Social security contributions | 33 | 4,100 |

| Total tax revenue | - | 11,600 |

Using the data in Table 2, calculate the price elasticity of demand (PED) for timber in Estonia when the price increases from €120 per cubic meter to €140 per cubic meter.

Using the data in Table 1, calculate the approximate nominal percentage increase in Estonia’s GDP from 2021 to 2022. Show your working.

Referring to Table 3, calculate the share of personal income tax revenue as a percentage of Estonia’s total tax revenue in 2022.

Using the information in Table 3, calculate the additional revenue the government would gain if the personal income tax rate rose from 20% to 22%, assuming the tax base remains unchanged.

Define the term “Keynesian multiplier.”

Using an AD/AS diagram, explain how an increase in government spending might affect real GDP in Estonia.

Using the data from Table 3, calculate what percentage of Estonia's total tax revenue comes from VAT. Show your working.

Using information from the text and Table 1, explain two ways in which Estonia’s rising inflation rate might affect income inequality.

Using the text/data provided and your knowledge of economics, recommend a policy which the Estonian government could introduce to address the high rate of inflation. Justify your recommendation.

Greenland, an autonomous territory of Denmark, is the world’s largest island with a population of about 56000 people. The economy relies heavily on fisheries (accounting for more than 90% of Greenland’s total exports), public sector services financed through grants from Denmark, and (increasingly) tourism. Recent explorations suggest that Greenland has untapped reserves of minerals and rare earth elements. However, high infrastructure costs and environmental considerations pose challenges to diversification.

Real GDP growth has been volatile due to changes in global demand for fish products and fluctuations in fish prices, while the population faces income inequality concerns. Recent debates in Greenland’s Parliament (Inatsisartut) focus on reforms to taxation and public spending, seeking to foster inclusive economic growth and reduce income disparities.

Table 1: Key Macroeconomic Indicators of Greenland (2018–2021)

| Indicator | 2018 | 2019 | 2020 | 2021 |

|---|---|---|---|---|

| Nominal GDP (bn DKK) | 15.8 | 16.5 | 16.3 | 17.0 |

| Real GDP growth (%) | 2.4 | 3.0 | -1.2 | 2.1 |

| Unemployment rate (%) | 6.2 | 5.5 | 7.1 | 6.4 |

| Gini coefficient | 0.32 | 0.34 | 0.35 | 0.35 |

| Government budget balance (% of GDP) | -2.2 | -1.5 | -4.0 | -3.0 |

Table 2: Fish Exports Data (2019–2021)

| Year | Fish exports (tonnes) | Average price per tonne (DKK) | Estimated PED for Greenlandic halibut |

|---|---|---|---|

| 2019 | 25 000 | 25 000 | -0.8 |

| 2020 | 24 000 | 27 500 | -0.7 |

| 2021 | 27 000 | 28 000 | -0.6 |

Table 3: Income Distribution and Taxation(2021)

| Income group | Share of total population (%) | Average annual income (DKK) | Tax rate (%) |

|---|---|---|---|

| Low-income | 25 | 140 000 | 35 |

| Middle-income | 50 | 250 000 | 40 |

| High-income | 25 | 600 000 | 45 |

Figure 1: Simplified market for Greenlandic Halibut (2021)

Prices are measured in DKK per tonne. Demand (D) and supply (S) represent domestic demand and supply. Pw1 is the initial world price of 28 000 DKK per tonne, while Pw2 is a possible world price of 30 000 DKK per tonne.

Using information from Table 1, calculate Greenland’s approximate nominal GDP per capita for 2021, given that the population was 56 000. Show your workings.

Based on Table 1, calculate Greenland’s average annual real GDP growth rate over the period 2018–2021 (use simple arithmetic mean of the four rates, treating the negative number for 2020 as part of the calculation). Show your workings.

Using the data from Table 2 for 2020 and 2021, calculate the percentage change in total export revenue (in DKK) from Greenlandic halibut.

Refer to Figure 1. Assume the price for Greenlandic halibut rises from Pw1 = 28 000 DKK per tonne to Pw2 = 30 000 DKK per tonne. Using the PED value of -0.6 for 2021, calculate the approximate percentage change in quantity demanded for Greenlandic halibut.

Define the term “progressive tax.”

Using a Keynesian multiplier diagram (AD/AS with an upward sloping AS), explain how an increase in government spending (funded partly by Danish block grants) could affect Greenland’s real GDP in the short run.

Using Table 3, calculate the total income tax paid by the low-income group in Greenland in 2021. Assume the group consists of 25% of the 56 000 population and that everyone earns the average income stated. Show your workings.

Using information from the text and Tables 1 and 3, explain two reasons why persistent inequality (as indicated by the Gini coefficient and tax data) could be harmful to Greenland’s long-term economic growth.

Using the text/data provided and your knowledge of economics, recommend a policy which could be implemented by Greenland’s Parliament in order to reduce income inequality and support long-term economic growth. Justify your recommendation.

Japan–European Union Economic Partnership Agreement (JEEPA)

-

In July 2017, the Japan–European Union Economic Partnership Agreement (JEEPA) was announced and it may come into force in 2019. Jointly, Japan and the European Union (EU) currently account for 28 % of global gross domestic product (GDP). The trade agreement could raise the EU’s exports to Japan by 34 % and Japan’s exports to the EU by 29 %. Economists say that this trade agreement marks a determined effort to combat rising protectionism and sends a powerful signal that cooperation, not trade protection, is the way to tackle global challenges.

-

The largest benefit to Japan will be for Japanese car manufacturers, as Europe will gradually lower tariffs from 10 % on Japanese cars. Car tariffs are a big concern for Japanese car manufacturers, who struggle to compete with South Korean car manufacturers. South Korean cars are sold to the EU tariff-free thanks to a free trade agreement signed in 2011. Within Europe, car manufacturers are one of the largest sources of jobs. Car manufacturers in the EU are concerned that cutting tariffs on car imports from Japan may lead to a large increase of Japanese cars into the European market.

-

The trade agreement will also resolve non-tariff barriers, such as technical requirements and regulations. More importantly, however, the EU and Japan will make their environmental and safety standards on cars the same, which will make trade easier.

-

Japanese politicians have been defending their relatively inefficient farmers for a long time. Now, Japan will lower tariffs on European meat, dairy products and wine, cutting 85 % of the tariffs on food products coming into Japan. This includes removing the current 30 % tariff on some European cheeses, such as cheddar and gouda cheese. However, imported camembert cheese will face a quota. This may be because Japan produces some camembert cheese.

-

JEEPA is particularly alarming for United States (US) beef and pork farmers because Japan has been the biggest export market for US beef and the second biggest export market for US pork. Any preferential tariff that EU farmers receive will make it much tougher for American farmers to sell meat in Japan.

-

With this trade agreement, the EU and Japan are trying to promote the values of economic cooperation and environmental conservation, which are both important for long-term economic growth and sustainability. However, JEEPA faces significant challenges because it will have to be passed by the Japanese Parliament, the European Parliament and European national governments. There is no guarantee that all governments will agree to the economic partnership.

Source: adapted from The Japan-EU Trade Agreement: Pushing Back Against Protectionism, http://globalriskinsights.com, 15 July 2017; Japan-EU trade agreement may hurt U.S. meat producers, by Katherine Hyunjung Lee, Jul 12, 2017, _Medill_ _News Service_, https://dc.medill.northwestern.edu; and A new trade deal between the EU and Japan, _The Economist_ (London, England), Jul 8th 2017, https://www.economist.com/finance-and-economics/2017/07/08/a-new-trade-deal-between-the-eu-andjapan. © The Economist Newspaper Limited, London, July 8th 2017

Define the term quota indicated in bold in the text (paragraph ).

Define the term sustainability indicated in bold in the text (paragraph ).

Using an AD/AS diagram, explain the impact of the trade agreement between Japan and the EU (JEEPA) on Japan’s economic growth (paragraph ).

Using an international trade diagram, explain the likely impact of Japan “removing the current 30 % tariff” on the level of cheddar cheese imports. (paragraph ).

Using information from the text/data and your knowledge of economics, evaluate the possible consequences of the trade agreement between Japan and the EU (JEEPA).