- IB

- 2.11 Market failure - market power (HL only)

Practice 2.11 Market failure - market power (HL only) with authentic IB Economics exam questions for both SL and HL students. This question bank mirrors Paper 1, 2, 3 structure, covering key topics like microeconomics, macroeconomics, and international trade. Get instant solutions, detailed explanations, and build exam confidence with questions in the style of IB examiners.

Explain the characteristics of an oligopoly market.

Evaluate the effectiveness of using indirect taxation to correct market failure.

Explain why harmful goods are an example of market failure.

Explain why a loss-making company in perfect competition is likely to shut down in the long run.

Using real-world examples, evaluate the view that perfect competition is a more desirable market structure than monopolistic competition.

Discuss the perspective that the excessive use of shared access resources is best managed by authorities.

Explain how variations in price function to redistribute resources in a market.

Note that a widget is an imaginary product.

In the country of Laurania, the widget industry operates as an oligopoly. The Minister for Finance is worried that the firms in the industry might abuse their power by acting together as a monopoly, and has said that the industry’s concentration ratio is cause for concern.

A firm operates under conditions of diminishing returns.

The demand curve faced by firms in the widget industry is downward sloping.

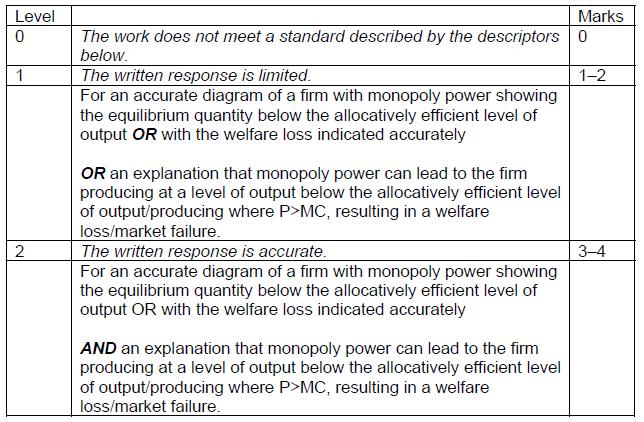

Figure 3 shows the marginal cost (MC) curve, the average variable cost (AVC) curve and the average total cost (ATC) curve for a firm in the widget industry.

Figure 3

One firm in the widget industry uses the practice of price discrimination, charging a lower price to one group of consumers than to another group, even though there is no difference in the cost of supplying to each group.

Outline how a concentration ratio might be used to identify an oligopoly.

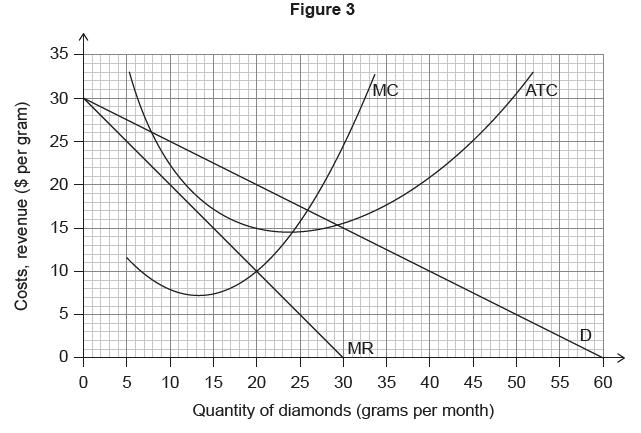

Using a diagram to support your answer, explain how monopoly power can create a welfare loss.

Calculate the firm’s total variable costs if output is 20 000 widgets per month.

Identify the level of output at which the firm would achieve productive efficiency.

Calculate the firm’s monthly total fixed costs if output equals 50 000 units per month.

State two conditions necessary for price discrimination to take place.

Using a diagram (or diagrams), explain why a profit maximizing firm might charge a higher price in one market than in another.

Sketch the total product (TP) curve for this firm.

State two government responses to the abuse of monopoly power.

Sketch the marginal revenue (MR) curve for firms in the widget industry.

Sketch the total revenue (TR) curve for firms in the widget industry.

It has been observed that the law of diminishing returns operates in the widget industry.

Outline the law of diminishing returns.

Sketch the marginal product (MP) and average product (AP) curves for this firm.

Country X and Country Y are capable of producing both apples and bananas. Assume a two-country, two-product model.

Country Y has absolute advantage in the production of both apples and bananas, and comparative advantage in the production of bananas.

The market for oranges in Country Z is illustrated on Figure 5.

Figure 5

The domestic demand and supply for oranges are given by the functions

Qd = 300 − 100_P_

Qs = − 60 + 60_P_

where P is the price of oranges in dollars per kilogram ($ per kg), Qd is the quantity of oranges demanded (thousands of kg per month) and Qs is the quantity of oranges supplied (thousands of kg per month). The world price of oranges is $2 per kg.

Due to increased awareness of the possible health benefits of vitamin C, the demand for oranges in Country Z increases by 60 000 per month at each price.

Tanya is a currency speculator. She buys and sells currencies with the intention of making gains as a result of changes in the exchange values of currencies. Currently, she is holding US$300 000, but she expects that in the next few months the euro (EU€) (the currency of the eurozone) will appreciate against the US dollar (US$).

At present, EU€1 = US$1.20.

Tanya exchanges her US$ for EU€.

The EU€ depreciates by 10 % against the US$. Fearing further depreciation of the EU€, Tanya exchanges her EU€ for US$.

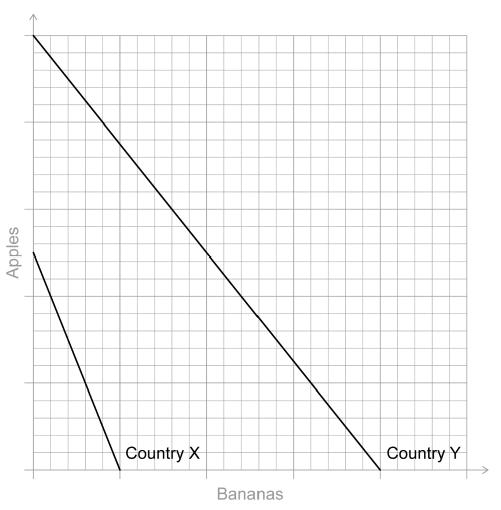

Sketch and label a diagram to illustrate comparative advantage between Country X and Country Y on Figure 4.

Figure 4

Outline the reason why Country X should specialize in the production of apples and Country Y should specialize in the production of bananas.

Outline one reason why it might not be in a country’s best interests to specialize according to the principle of comparative advantage.

Calculate the change in expenditure on imported oranges as a result of the increase in demand.

Calculate the change in consumer surplus in Country Z as a result of the increase in demand for oranges.

Calculate the change in social (community) surplus as a result of the increase in demand for oranges.

State one administrative barrier that Country Z could use in order to restrict imports.

Explain two possible economic consequences for the eurozone if the euro appreciates.

Calculate the quantity of EU€ she will receive for her US$300 000.

Calculate, in US$, the loss made by Tanya as a result of these transactions.

Explain two reasons why a government might prefer a floating exchange rate system for its currency.

Explain how the principle of diminishing returns affects a company's short-term cost curves.

Using real-world examples, discuss the view that monopoly is an unfavorable market structure as it fails to achieve productive and allocative efficiency.

Firm A, which is operating in a perfectly competitive market, produces almonds. Figure 1 illustrates Firm A’s average total cost (ATC), average variable cost (AVC) and marginal cost (MC) curves at different output levels.

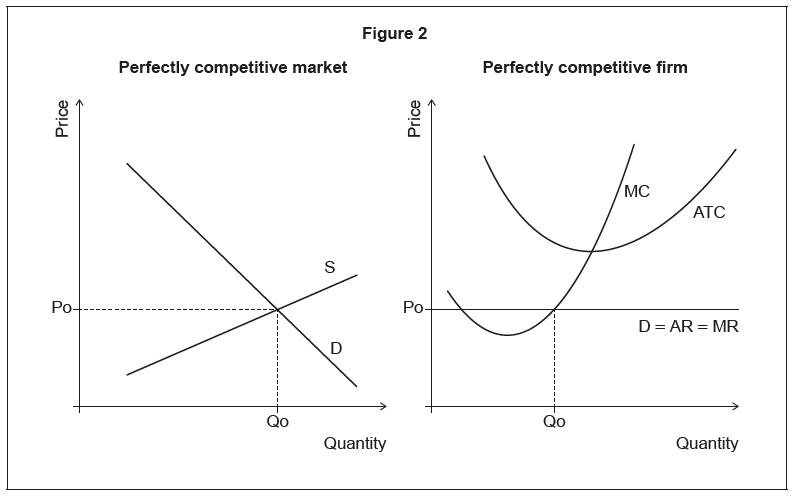

Figure 2 illustrates a perfectly competitive market in equilibrium and a perfectly competitive firm operating in this market. S is supply, D is demand, Po is the short-run equilibrium price, Qo is the short-run equilibrium quantity, MC is marginal cost, ATC is average total cost, AR is average revenue, MR is marginal revenue.

Firm B is a monopoly producer of diamonds. Figure 3 illustrates its demand (D), marginal revenue (MR), average total cost (ATC) and marginal cost (MC) curves at different output levels.

The market for shampoo displays the characteristics of monopolistic competition.

Using information from Figure 1, calculate Firm A’s total fixed costs.

The market price of almonds is $11 per kilogram. Using Figure 1, identify the quantity of almonds Firm A must produce in order to maximize profits.

Calculate the economic profit/loss when Firm A is producing at the output level identified in part (b)(i).

Based on the information in Figure 2, state whether the firms in this market are making normal profits, economic profits or economic losses.

On Figure 2, draw and label appropriate additional curves to show how a perfectly competitive market will move from short-run equilibrium to long-run equilibrium.

Using your answer to part (c)(ii), explain how the market adjustment takes place.

State two assumed characteristics of a monopoly.

Explain two reasons why a monopoly may be considered desirable for an economy.

Using Figure 3, calculate the economic profit when Firm B is maximizing its profits.

Using Figure 3, calculate the total revenue when Firm B is maximizing its revenue.

A shampoo firm is earning economic profits. Outline, with a reason, what will happen to its demand curve in the long run.

Sketch and label a diagram to illustrate the long-run equilibrium for a firm in monopolistic competition.

Explain the shape of the long-run average total cost curve.

Using real-world examples, evaluate fines as a measure against firms with large market power.

Microeconomics

Explain why merit goods tend to be under-provided in a free market.

Evaluate the use of carbon taxes to reduce threats to sustainability.