Practice 2.3 Competitive Market Equilibrium with authentic IB Economics exam questions for both SL and HL students. This question bank mirrors Paper 1, 2, 3 structure, covering key topics like microeconomics, macroeconomics, and international trade. Get instant solutions, detailed explanations, and build exam confidence with questions in the style of IB examiners.

CASE STUDY: Economic Developments and Challenges in Azerbaijan

-

Azerbaijan, situated at the crossroads of Eastern Europe and Western Asia, has experienced significant economic reforms over the past decade. Historically reliant on hydrocarbons-mainly oil and natural gas—for export revenues, the country has sought to diversify its production base through agriculture, tourism, and technology sectors. In 2019, oil and gas accounted for about 85% of Azerbaijan's total exports, providing substantial government revenue but leaving the country vulnerable to global commodity price fluctuations.

-

In recent years, policymakers have introduced multiple initiatives to modernize infrastructure and reduce dependence on hydrocarbons. Between 2019 and 2022, the government invested over US$3 billion in roads, railways, and energy transmission lines, aiming to expand the country's capacity to produce and transport goods. According to the State Statistical Committee, Azerbaijan's real GDP grew by 2.2% in 2020 and rebounded to 4.6% in 2022, partly due to a recovery in global oil prices. However, structural unemployment persists, especially in rural areas, where older agricultural practices lag behind modern production techniques.

-

Inflation, driven by rising global commodity costs, reached 8.4% in 2022, up from 2.6% in 2019. The Central Bank of Azerbaijan responded with conservative monetary policies that have stabilized the exchange rate of the Azerbaijani manat. Meanwhile, the government introduced tariffs on certain imported agricultural goods in 2021, aiming to protect local farmers from competition and stimulate domestic production. Critics argue that these tariffs lead to higher prices for consumers, while supporters believe they create incentives for farmers to modernize and invest in capital-intensive farming techniques.

-

Foreign direct investment (FDI) centered on the energy sector remains strong, although officials are eager to attract in manufacturing and services. Improvements in transport connectivity-facilitated by ongoing infrastructure projects-have encouraged discussions about further liberalizing trade regulations to boost exports of textiles, food products, and tech services. Yet logistical barriers at border checkpoints persist, contributing to delays and raising costs for exporters looking to access regional markets.

-

Socially, Azerbaijan has implemented targeted measures to address income inequality, including subsidies for utilities and food staples. Observers note that the impact of these subsidies can be uneven; while they help low-income households cope with rising prices, they can also create fiscal pressure if oil revenues decline. The government has recently introduced pilot programs that tie subsidies to specific income thresholds, with the objective of reducing misuse of public funds.

-

Despite ambitious diversification plans, the oil sector continues to dominate. Economic analysts warn that reliance on hydrocarbons could impede sustainable growth, especially if global oil prices weaken or external demand slows. As part of its long-term development strategy, the government is promoting investment in green energy, incentivizing solar and wind power projects in the hope of creating new export opportunities for electricity.

-

Nonetheless, concerns about structural unemployment remain. Skill mismatches persist between job seekers and the needs of modern industries, particularly in the technology sector. Rural-urban migration has become more common, pressuring housing and public services in Baku, while leaving some villages with labor shortages. Recognizing these challenges, the Ministry of Education has partnered with private companies to revamp vocational education programs, aiming to align training with rapidly evolving market demands.

Table 1: Selected Macroeconomic Indicators for Azerbaijan (2019-2022)

| Indicator | 2019 | 2020 | 2021 | 2022 | |

|---|---|---|---|---|---|

| Nominal GDP (US$ billion) | 47.0 | 42.5 | 45.8 | 52.0 | |

| Real GDP Growth Rate (%) | 2.2 | 2.2 | 3.4 | 4.6 | |

| Inflation Rate (%) | 2.6 | 3.0 | 4.5 | 8.4 | |

| Unemployment Rate (%) | 5.3 | 6.5 | 6.2 | 5.9 | |

| Exchange Rate (AZN per US$) | 1.70 | 1.70 | 1.70 | 1.69 | |

| Govt. Capital Spending (US$ billion) | 0.9 | 1.4 | 2.2 | 2.4 |

Table 2: Trade and Social Indicators

| Indicator | 2019 | 2021 | 2022 |

|---|---|---|---|

| Oil/Gas Exports as % of Total Exports | 85% | 85% | |

| Agricultural Tariff Rate (selected products) | 0% | 10% | |

| Gini Coefficient | 0.33 | 0.34 | 0.35 |

| Avg. Monthly Household Subsidy (utilities & food) | US$40 | US$45 | |

| FDI Inflows (US$ billion) | 4.2 | 3.7 | 4.0 |

QUESTIONS

Define the term tariffs indicated in the text (paragraph 3).

Define the term structural unemployment indicated in the text (paragraph 2).

CASE STUDY: Economic Developments and Challenges in Azerbaijan

-

Azerbaijan, situated at the crossroads of Eastern Europe and Western Asia, has experienced significant economic reforms over the past decade. Historically reliant on hydrocarbons-mainly oil and natural gas—for export revenues, the country has sought to diversify its production base through agriculture, tourism, and technology sectors. In 2019, oil and gas accounted for about 85% of Azerbaijan's total exports, providing substantial government revenue but leaving the country vulnerable to global commodity price fluctuations.

-

In recent years, policymakers have introduced multiple initiatives to modernize infrastructure and reduce dependence on hydrocarbons. Between 2019 and 2022, the government invested over US$3 billion in roads, railways, and energy transmission lines, aiming to expand the country's capacity to produce and transport goods. According to the State Statistical Committee, Azerbaijan's real GDP grew by 2.2% in 2020 and rebounded to 4.6% in 2022, partly due to a recovery in global oil prices. However, structural unemployment persists, especially in rural areas, where older agricultural practices lag behind modern production techniques.

-

Inflation, driven by rising global commodity costs, reached 8.4% in 2022, up from 2.6% in 2019. The Central Bank of Azerbaijan responded with conservative monetary policies that have stabilized the exchange rate of the Azerbaijani manat. Meanwhile, the government introduced tariffs on certain imported agricultural goods in 2021, aiming to protect local farmers from competition and stimulate domestic production. Critics argue that these tariffs lead to higher prices for consumers, while supporters believe they create incentives for farmers to modernize and invest in capital-intensive farming techniques.

-

Foreign direct investment (FDI) centered on the energy sector remains strong, although officials are eager to attract in manufacturing and services. Improvements in transport connectivity-facilitated by ongoing infrastructure projects-have encouraged discussions about further liberalizing trade regulations to boost exports of textiles, food products, and tech services. Yet logistical barriers at border checkpoints persist, contributing to delays and raising costs for exporters looking to access regional markets.

-

Socially, Azerbaijan has implemented targeted measures to address income inequality, including subsidies for utilities and food staples. Observers note that the impact of these subsidies can be uneven; while they help low-income households cope with rising prices, they can also create fiscal pressure if oil revenues decline. The government has recently introduced pilot programs that tie subsidies to specific income thresholds, with the objective of reducing misuse of public funds.

-

Despite ambitious diversification plans, the oil sector continues to dominate. Economic analysts warn that reliance on hydrocarbons could impede sustainable growth, especially if global oil prices weaken or external demand slows. As part of its long-term development strategy, the government is promoting investment in green energy, incentivizing solar and wind power projects in the hope of creating new export opportunities for electricity.

-

Nonetheless, concerns about structural unemployment remain. Skill mismatches persist between job seekers and the needs of modern industries, particularly in the technology sector. Rural-urban migration has become more common, pressuring housing and public services in Baku, while leaving some villages with labor shortages. Recognizing these challenges, the Ministry of Education has partnered with private companies to revamp vocational education programs, aiming to align training with rapidly evolving market demands.

Table 1: Selected Macroeconomic Indicators for Azerbaijan (2019-2022)

| Indicator | 2019 | 2020 | 2021 | 2022 | |

|---|---|---|---|---|---|

| Nominal GDP (US$ billion) | 47.0 | 42.5 | 45.8 | 52.0 | |

| Real GDP Growth Rate (%) | 2.2 | 2.2 | 3.4 | 4.6 | |

| Inflation Rate (%) | 2.6 | 3.0 | 4.5 | 8.4 | |

| Unemployment Rate (%) | 5.3 | 6.5 | 6.2 | 5.9 | |

| Exchange Rate (AZN per US$) | 1.70 | 1.70 | 1.70 | 1.69 | |

| Govt. Capital Spending (US$ billion) | 0.9 | 1.4 | 2.2 | 2.4 |

Table 2: Trade and Social Indicators

| Indicator | 2019 | 2021 | 2022 |

|---|---|---|---|

| Oil/Gas Exports as % of Total Exports | 85% | 85% | |

| Agricultural Tariff Rate (selected products) | 0% | 10% | |

| Gini Coefficient | 0.33 | 0.34 | 0.35 |

| Avg. Monthly Household Subsidy (utilities & food) | US$40 | US$45 | |

| FDI Inflows (US$ billion) | 4.2 | 3.7 | 4.0 |

QUESTIONS

Define the term tariffs indicated in the text (paragraph 3).

Define the term structural unemployment indicated in the text (paragraph 2).

Explain how the price mechanism leads to an efficient allocation of resources without government intervention.

Explain how shifts in the demand and supply curves affect the market equilibrium price and quantity.

Greenland, an autonomous territory of Denmark, is the world’s largest island with a population of about 56000 people. The economy relies heavily on fisheries (accounting for more than 90% of Greenland’s total exports), public sector services financed through grants from Denmark, and (increasingly) tourism. Recent explorations suggest that Greenland has untapped reserves of minerals and rare earth elements. However, high infrastructure costs and environmental considerations pose challenges to diversification.

Real GDP growth has been volatile due to changes in global demand for fish products and fluctuations in fish prices, while the population faces income inequality concerns. Recent debates in Greenland’s Parliament (Inatsisartut) focus on reforms to taxation and public spending, seeking to foster inclusive economic growth and reduce income disparities.

Table 1: Key Macroeconomic Indicators of Greenland (2018–2021)

| Indicator | 2018 | 2019 | 2020 | 2021 |

|---|---|---|---|---|

| Nominal GDP (bn DKK) | 15.8 | 16.5 | 16.3 | 17.0 |

| Real GDP growth (%) | 2.4 | 3.0 | -1.2 | 2.1 |

| Unemployment rate (%) | 6.2 | 5.5 | 7.1 | 6.4 |

| Gini coefficient | 0.32 | 0.34 | 0.35 | 0.35 |

| Government budget balance (% of GDP) | -2.2 | -1.5 | -4.0 | -3.0 |

Table 2: Fish Exports Data (2019–2021)

| Year | Fish exports (tonnes) | Average price per tonne (DKK) | Estimated PED for Greenlandic halibut |

|---|---|---|---|

| 2019 | 25 000 | 25 000 | -0.8 |

| 2020 | 24 000 | 27 500 | -0.7 |

| 2021 | 27 000 | 28 000 | -0.6 |

Table 3: Income Distribution and Taxation(2021)

| Income group | Share of total population (%) | Average annual income (DKK) | Tax rate (%) |

|---|---|---|---|

| Low-income | 25 | 140 000 | 35 |

| Middle-income | 50 | 250 000 | 40 |

| High-income | 25 | 600 000 | 45 |

Figure 1: Simplified market for Greenlandic Halibut (2021)

Prices are measured in DKK per tonne. Demand (D) and supply (S) represent domestic demand and supply. Pw1 is the initial world price of 28 000 DKK per tonne, while Pw2 is a possible world price of 30 000 DKK per tonne.

Using information from Table 1, calculate Greenland’s approximate nominal GDP per capita for 2021, given that the population was 56 000. Show your workings.

Based on Table 1, calculate Greenland’s average annual real GDP growth rate over the period 2018–2021 (use simple arithmetic mean of the four rates, treating the negative number for 2020 as part of the calculation). Show your workings.

Using the data from Table 2 for 2020 and 2021, calculate the percentage change in total export revenue (in DKK) from Greenlandic halibut.

Refer to Figure 1. Assume the price for Greenlandic halibut rises from Pw1 = 28 000 DKK per tonne to Pw2 = 30 000 DKK per tonne. Using the PED value of -0.6 for 2021, calculate the approximate percentage change in quantity demanded for Greenlandic halibut.

Define the term “progressive tax.”

Using a Keynesian multiplier diagram (AD/AS with an upward sloping AS), explain how an increase in government spending (funded partly by Danish block grants) could affect Greenland’s real GDP in the short run.

Using Table 3, calculate the total income tax paid by the low-income group in Greenland in 2021. Assume the group consists of 25% of the 56 000 population and that everyone earns the average income stated. Show your workings.

Using information from the text and Tables 1 and 3, explain two reasons why persistent inequality (as indicated by the Gini coefficient and tax data) could be harmful to Greenland’s long-term economic growth.

Using the text/data provided and your knowledge of economics, recommend a policy which could be implemented by Greenland’s Parliament in order to reduce income inequality and support long-term economic growth. Justify your recommendation.

Explain the concept of social surplus.

Using real-world examples, evaluate reductions in the minimum wage as a measure to maximise resource allocation in the labour market.

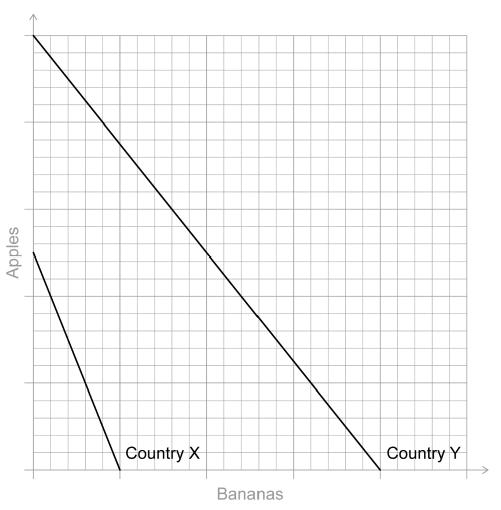

Country X and Country Y are capable of producing both apples and bananas. Assume a two-country, two-product model.

Country Y has absolute advantage in the production of both apples and bananas, and comparative advantage in the production of bananas.

The market for oranges in Country Z is illustrated on Figure 5.

Figure 5

The domestic demand and supply for oranges are given by the functions

Qd = 300 − 100_P_

Qs = − 60 + 60_P_

where P is the price of oranges in dollars per kilogram ($ per kg), Qd is the quantity of oranges demanded (thousands of kg per month) and Qs is the quantity of oranges supplied (thousands of kg per month). The world price of oranges is $2 per kg.

Due to increased awareness of the possible health benefits of vitamin C, the demand for oranges in Country Z increases by 60 000 per month at each price.

Tanya is a currency speculator. She buys and sells currencies with the intention of making gains as a result of changes in the exchange values of currencies. Currently, she is holding US$300 000, but she expects that in the next few months the euro (EU€) (the currency of the eurozone) will appreciate against the US dollar (US$).

At present, EU€1 = US$1.20.

Tanya exchanges her US$ for EU€.

The EU€ depreciates by 10 % against the US$. Fearing further depreciation of the EU€, Tanya exchanges her EU€ for US$.

Sketch and label a diagram to illustrate comparative advantage between Country X and Country Y on Figure 4.

Figure 4

Outline the reason why Country X should specialize in the production of apples and Country Y should specialize in the production of bananas.

Outline one reason why it might not be in a country’s best interests to specialize according to the principle of comparative advantage.

Calculate the change in expenditure on imported oranges as a result of the increase in demand.

Calculate the change in consumer surplus in Country Z as a result of the increase in demand for oranges.

Calculate the change in social (community) surplus as a result of the increase in demand for oranges.

State one administrative barrier that Country Z could use in order to restrict imports.

Explain two possible economic consequences for the eurozone if the euro appreciates.

Calculate the quantity of EU€ she will receive for her US$300 000.

Calculate, in US$, the loss made by Tanya as a result of these transactions.

Explain two reasons why a government might prefer a floating exchange rate system for its currency.

Explain how consumer nudges can reduce the consumption of demerit goods.

Using real-world examples, discuss the effectiveness of ad-valorem taxes in collecting government revenue.

Discuss the view that competitive markets will always achieve allocative efficiency.

Explain two factors that would lead to an increase in the demand for a commodity.

Microeconomics

Explain the view that the best allocation of resources occurs when consumer surplus and producer surplus are maximized.

Discuss the implications of the direct provision of public goods by a government.