Business cycle

Fluctuations in the growth of real output, characterised by alternating phases of expansion (rising real output) and contraction (falling real output).

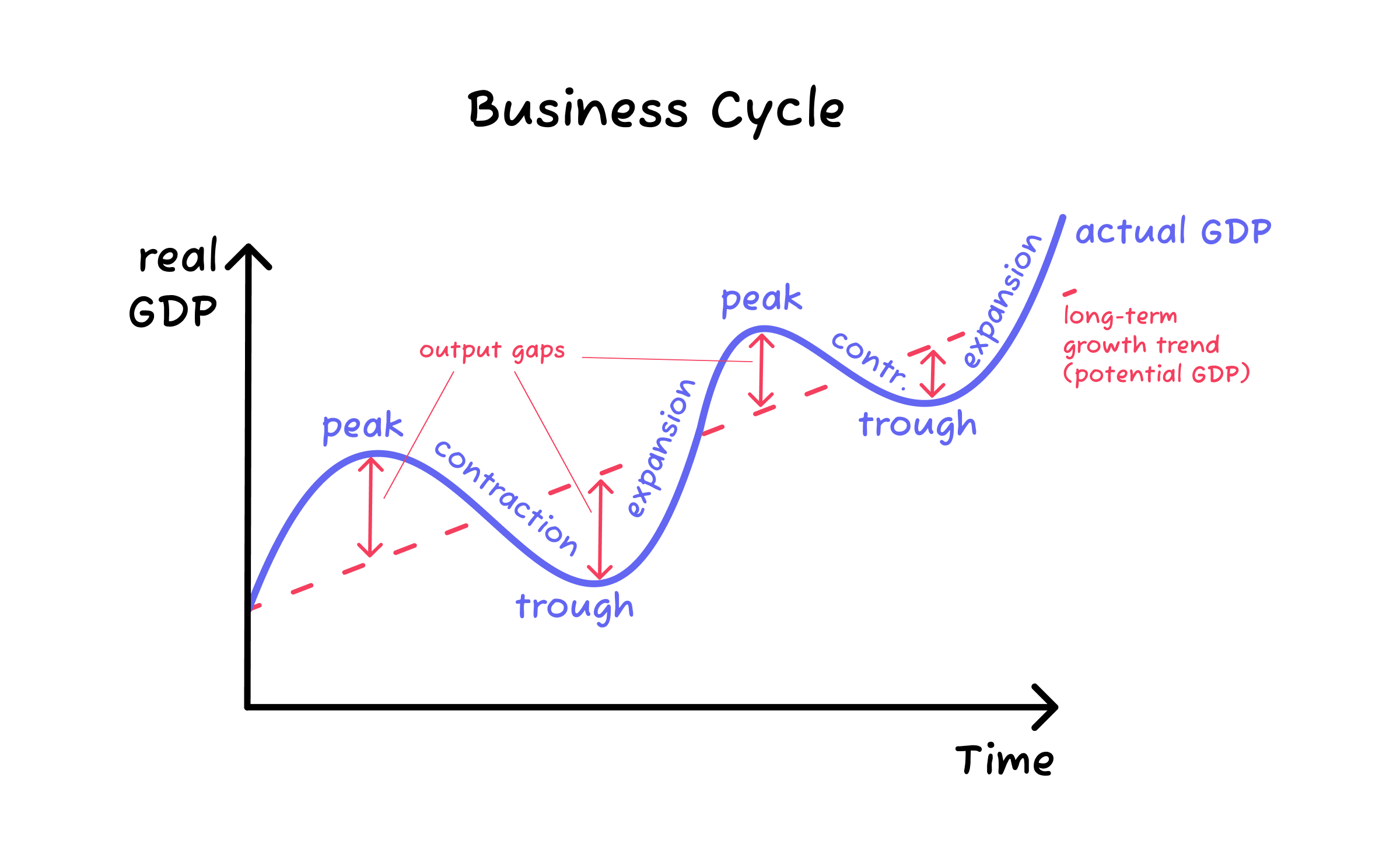

- The business cycle refers to the periodic ups and downs in economic activity over time.

- It tracks how real GDP (Gross Domestic Product) fluctuates above and below its long-term growth trend.

- These cycles are a natural feature of economies, influenced by factors such as changes in aggregate demand and supply, external shocks, and government policies.

Pay attention to the axis of Figure 1.

- The 'x axis' represents 'time'.

- The 'y axis' represents the 'real GDP' of an economy.

The phases of the business cycle

The business cycle consists of four key phases, each with unique characteristics. These four phases can be seen in Figure 1 above.

Expansion

A period of positive real GDP growth.

Characteristics:

- Employment of resources increases.

- Accompanied by rising general price levels (inflation).

Expansions are represented by upward-sloping sections of the business cycle curve.

Peak

The maximum level of real GDP in a cycle, marking the end of an expansion.

Characteristics:

- At its peak, the economy reaches its lowest unemployment of resources in the cycle.

- The average price level is still rising rapidly, leading to inflationary pressures.

Peaks are represented by the maximums of the business cycle curve.

Contraction

A period of negative real GDP growth (falling real output).

Characteristics:

- Rising unemployment, causing firms to reduce output.

- Price levels stop increasing rapidly, and even decrease in some cases.

Contractions are represented by downward-sloping sections of the business cycle curve.

Recession

Sustained falling real output in an economy (a contraction in the business cycle) lasting two consecutive quarters (6 months).

Trough

The lowest level of real GDP in a cycle, marking the end of a contraction.

Characteristics:

- Highest unemployment in the business cycle.

- Price levels remain increasing slowly, or even decreasing.

- Signals the beginning of a new expansion phase.

Troughs are represented by the minimums of the business cycle curve.

TipThe table below summarises the different characteristics of the business cycle phases:

| Real GDP | Unemployment | Price level | |

|---|---|---|---|

| Expansion | Rising | Falling | Rising |

| Peak | Maximum | Minimum | Rising |

| Contraction | Falling | Rising | Stable or decreasing |

| Trough | Minimum | Maximum | Stable or decreasing |

Potential output and output gaps

Potential output

- The level of real GDP the economy produces when resources (labor, capital, etc.) are used efficiently, at full employment.

- Full employment occurs when the unemployment equals the natural rate of unemployment.

- When an economy operates at full employment, it does not mean that all of its resources are being utilised.

- At full employment, there is still some unemployment of resources referred to as the natural rate of unemployment.

- The natural rate of unemployment accounts for the unemployment that arises due to people switching jobs, locations, training to develop new job skills...

- The potential output reflects the long-term economic growth trend of an economy, showcasing the upwards tendency of the output gaps' fluctuations.

- The potential output can be visualised by the dashed line in Figure 1.

We will discuss the natural rate of unemployment in depth in Subtopic 3.3.3.

Output gaps

Output gaps occur when actual GDP deviates from potential GDP, reflecting fluctuations in resource utilisation.

- Positive Output Gap:

- Actual GDP > Potential GDP (during an expansion).

- Indicates the economy is operating beyond its full employment of resources.

- Results in lower unemployment than the natural rate of unemployment.

- It often leads to upward pressure on wages and prices (inflation).

- Negative Output Gap:

- Actual GDP < Potential GDP (during a contraction).

- Signals underutilisation of resources, with higher unemployment levels than the natural rate of unemployment.

- It often reduces the inflationary pressures on wages and prices (sometimes even leading to falls in the price level).